02 October 2020

10 min read

#Superannuation, Funds Management & Financial Services, #COVID-19

Published by:

ASIC updates the fees and costs disclosure regime (9 September 2020)

ASIC reminded trustees that they can choose to opt-in to the new fees and costs regime for periodic and exit statements (which commenced from 1 July 2020) and for product disclosure statements (PDS) from 30 September 2020. To opt-in, the trustee must make a written record that includes the date of election and the PDS or product to which the election applies.

A key deadline is the requirement that periodic and exit statements with reporting periods commencing on 1 July 2021 must comply with the new requirements, meaning that the new requirements for exit statements will be triggered for exits on or after 1 July 2021.

ASIC will continue to develop its proposals on disclosure by platforms.

Our thoughts

We discussed these new rules in our April newsletter here. In short, ASIC Corporations (Amendment) Instrument 2019/1071 and ASIC Corporations (Disclosure of Fees and Costs) Instrument 2019/1070 were registered, amending and then repealing ASIC Class Order [CO 14/1252].

However, COVID-19 resulted in ASIC Corporations (Amendment and Repeal) Instrument 2020/579 being introduced to:

Treasury Laws Amendment (Release of Superannuation on Compassionate Grounds) Regulations (No. 3) 2020 (3 September 2020)

The regulations extend the deadline by which applications must be made for COVID-19-related early release from superannuation accounts, to 31 December 2020.

Parliamentary Contributory Superannuation (Early Release Payments) Amendment Regulations 2020 (3 September 2020)

The regulations extend the deadline by which applications must be made for COVID-19-related early release from the Parliamentary Contributory Superannuation Scheme, to 31 December 2020.

Superannuation Amendment (PSSAP Membership) Bill 2020 (7 September 2020)

The Bill enables certain current and former Commonwealth employees and statutory office holders to continue to be or to become contributory members of the Public Sector Superannuation Accumulation Plan if they are currently not eligible to do so.

Anti-Money Laundering and Counter-Terrorism Financing Rules Amendment Instrument 2020 (No. 4) (14 September 2020)

The Instrument extends the AML/CTF Rules’ exemption from the applicable customer identification procedure when trustees make payments under the early release of superannuation scheme, until 31 December 2020.

ASIC Corporations (Amendment) Instrument 2020/853 (22 September 2020)

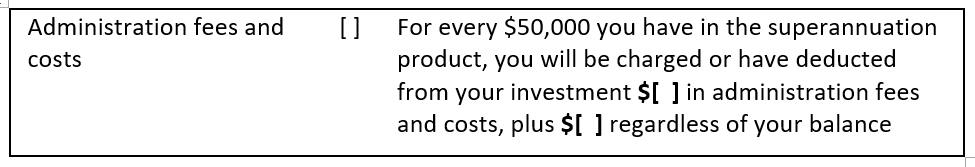

The Instrument amends ASIC Corporations (Disclosure of Fees and Costs) Instrument 2019/1070 (Fees and Costs Instrument) by requiring trustees who charge an asset-based administration fee or a combination of asset-based and fixed administration fees and costs (Administration Fees) to provide different disclosure in the annual fees and costs example (Example) that applies to representative members (i.e. those with an account balance of $50,000).

The amendments apply once trustees commence providing disclosure, pursuant to the Fees and Costs Instrument (which, for most trustees will be 30 September 2022).

Our thoughts

This is the second amendment made to the Fees and Costs Instrument (the first was COVID-19-related) and it is foreseeable that further amendments will be made over time.

The amendment means that the Example’s Administration Fee row will appear as follows, for some trustees:

Certain questions arise as to whether the amendment creates some confusion:

A lot of explanation for one seemingly innocuous row of disclosure...

Australian Securities and Investments Commission v MLC Nominees Pty Ltd [2020] FCA 1306 (11 September 2020)

The Federal Court has ordered two entities in NAB’s wealth management division (NULIS Nominees (Australia) Limited (NULIS) and MLC Nominees Pty Ltd (MLC Nominees)) to pay a total $57.5 million penalty after the court found the trustees had made false and misleading representations to superannuation members about their entitlement to charge plan service fees and members’ obligations to pay the fees.

The court also made declarations that MLC Nominees and NULIS failed to ensure that their financial services were provided efficiently, honestly and fairly.

The court’s orders and declarations were made following its findings that:

Review of the Legislative Framework for Corporations and Financial Services Regulation (11 September 2020)

The Australian Law Reform Commission (ALRC) has been asked to inquire into the potential simplification of Australian financial services law (Inquiry).

The Inquiry is part of the government’s response to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry released in February 2019. The ALRC is not tasked with recommending policy changes regarding the content of obligations on financial service providers. Rather, the ALRC is to consider whether, and if so what, changes could be made to the Australian financial services law to simplify and rationalise the law.

Three sub-topics are specifically outlined, each of which is to be the subject of an interim report by the ALRC before the release of the consolidated Final Report:

Our thoughts

We envisage the findings in these reports will be highly anticipated.

Proposed changes to AFCA Rules – the transfer of remaining SCT complaints to AFCA (21 September 2020)

AFCA is seeking consultation in respect of proposed AFCA Rule changes resulting from the SCT ceasing operations after 31 December 2020. AFCA needs to amend its Rules to ensure there are appropriate arrangements in place to address the following possible events:

The proposed changes will allow AFCA to consider these complaints and will not otherwise affect what complaints it can consider. Accordingly, AFCA is seeking consultation from interested parties.

Further, AFCA proposes to make two minor technical changes to the Rules to:

Following consultation, the proposed amendments to the Rules will be submitted to ASIC for review and approval, which may result in further changes. It is anticipated that the relevant amendments to the Rules will be released by January 2021.

Submissions are due to AFCA by 16 October 2020.

The AFCA Approach to delayed insurance claims in superannuation (21 September 2020)

This document sets out how AFCA approaches complaints about delays in handling insurance claims held through superannuation. It forms part of a broader suite of guidance on how AFCA resolves superannuation complaints and includes case studies.

The document can be downloaded here.

Author: Luke Hooper

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this newsletter is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: