02 February 2022

6 min read

#Taxation, #Dispute Resolution & Litigation

Published by:

With the ATO’s guidance on section 100A of the Income Tax Assessment Act 1936 (ITAA36) rumoured to be imminently released, the Federal Court’s recent decision in Guardian AIT Pty Ltd ATF Australian Investment Trust v Commissioner of Taxation [2021] FCA 1619 (Guardian) is of compelling interest to tax professionals across the country.

The draft guidance set to be released by the ATO on section 100A is widely regarded amongst industry professionals as a “hot topic”. In November 2021, Deputy Commissioner of Private Wealth, Louise Clark, informed tax professionals present at her “ATO Hot Topics” presentation at the Noosa Tax Intensive that the section 100A guidance was ready to be issued. However, due to “feedback from the tax profession that they were fatigued from the impact of COVID-19”, the ATO rescheduled the release of the guidance to early in the new year instead.

Yet, potentially throwing a spanner in the works, on 21 December 2021, Justice Logan of the Federal Court found in favour of the taxpayer in Guardian and held there was no “reimbursement agreement” as defined in section 100A(13).

Overview

The decision concerned the amounts of net income of the Australian Investment Trust (AIT) appointed to AIT Corporate Services Pty Ltd (AITCS) in the income years ended 30 June 2012, 30 June 2013 and 30 June 2014 (the relevant years).

The Commissioner assessed the present entitlement of AITCS to the net income of the AIT in each of the relevant income years as an entitlement that arose from a reimbursement agreement or by reason of an act, transaction or circumstance in connection with, or as a result of, a reimbursement agreement under section 100A of the ITAA36.

As his alternative case, the Commissioner assessed Mr Springer under the general tax anti-avoidance provisions in Part IVA of the ITAA36.

Both taxpayers successfully appealed – for each of the years.

Background

Mr Springer was the ultimate owner and controller of a group of businesses he referred to as the ‘Springer Group’. Mr Springer was an arborist by trade but his business ventures extended beyond forestry to property development and property investment.

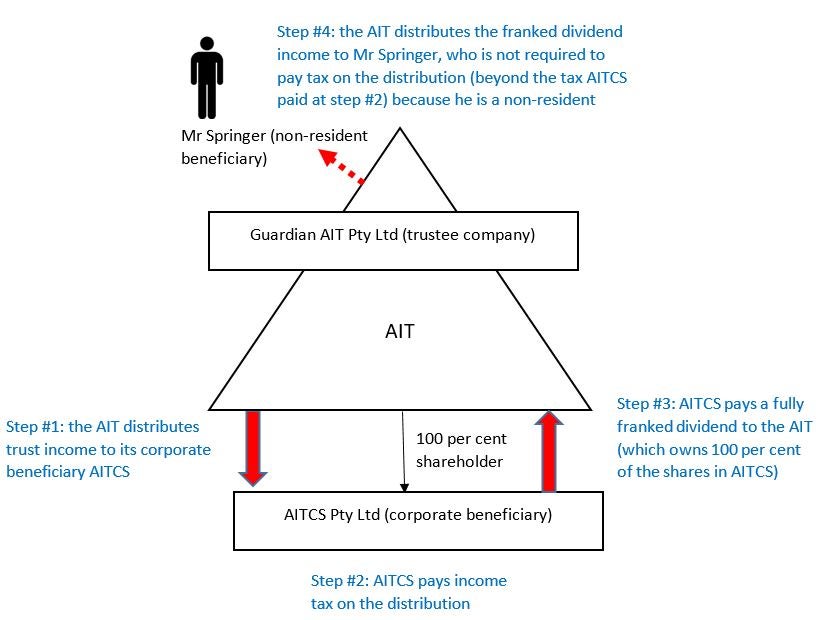

It was relevant to the proceedings that the Springer Group was being wound up because Mr Springer was transitioning to retirement and wished to “simplify his life”. It was also relevant to the proceedings that Mr Springer had moved to Vanuatu and had ceased to be an Australian resident. The tax years in dispute were 2012-2014. At this time, the relevant structure and events were (broadly):

The Commissioner issued amended assessments to Guardian AIT Pty Ltd as trustee for the AIT on the basis that there was a “reimbursement agreement” under section 100A. The Commissioner essentially argued there was an “understanding” by relevant parties that:

As AITCS paid 30 per cent tax on the distribution (step #2), the Commissioner’s apparent grievance was his inability to collect the “top up tax” of an additional 17 per cent (to bring the total tax paid on the trust distribution to 47 per cent instead of 30 per cent) that would have been payable had the AIT distributed its income directly to Mr Springer.

At trial, the issue was articulated as to whether, at the time AITCS became presently entitled to the income of the AIT, there was a “reimbursement agreement” as defined in sections 100A (7) and (13) of the ITAA36.

The taxpayer argued that there was no reimbursement agreement as there was no plan or expectation that AITCS would declare a dividend back to the AIT (step #3) at any point before the AIT distributed trust income to AITCS (step #1).

His Honour held that for there to be a reimbursement agreement it must precede the present entitlement of income. On the evidence at trial, His Honour found that there was no plan or understanding at any time preceding AIT’s distribution to AITCS that AITCS would declare a franked dividend, stating at [132], “there is just no support for this in the contemporaneous evidence” and:

“A hypothetical contingency open in law but never considered is not sufficient to yield that. It is only many months later that even the possibility of the declaring of a dividend by AITCS emerges. The requisite temporal sequence is lacking. There is no ‘relevant connection’.”

Accordingly, as AITCS was made presently entitled to AIT’s income before making any decision or plan to declare a franked dividend, His Honour found there could be no reimbursement agreement. His Honour further observed that even if there was an agreement, the arrangement was an ordinary family and commercial dealing (which is excluded from the definition of “agreement” in section 100A(13)):

“For the reasons which follow, the agreement was entered into in the course of ordinary family or commercial dealing….In this particular case, the incorporation of AITCS, its appointment as a member of the eligible beneficiary class and the resolution to make a distribution to it of trust income were each nothing more than an ordinary family or commercial dealing.”

The Commissioner also issued Mr Springer with an alternative assessment under the general anti-avoidance provisions in Part IVA of the ITAA. Mr Springer was successful in appealing these assessments.

The Commissioner argued the steps undertaken (these are broadly outlined in the above diagram) were undertaken with the dominant purpose of obtaining a tax benefit, namely the absence of “top up tax” on the distribution at step #4 to Mr Springer, which was not subject to any additional tax as it was non-assessable non-exempt income. Therefore, it was the Commissioner’s position that Part IVA should apply to cancel Mr Springer’s tax benefit.

However, His Honour concluded that there was no tax benefit and that the dominant purpose of the arrangement was not to obtain a tax benefit but was ([at 184]):

“There is a contrivance or artificiality about the (Commissioner’s) Primary Scheme, but that contrivance or artificiality is that of the Commissioner, informed by the false wisdom of hindsight. ….The dominant purpose….was always, on and from 27 June 2012, the minimisation of risk to Mr Springer in retirement and having a new corporate beneficiary in AIT’s eligibility class to which distributions might be made instead of to an individual and which might, into the indefinite future, serve as a vehicle for wealth accumulation and passive investment. This was always the ‘ruling, prevailing or most influential purpose’.”

This decision represents one of the first superior court decisions to consider (favourably) the role of asset protection and risk minimisation in the context of both section 100A and Part IVA.

When the Commissioner unveils the guidance on section 100A, it will provide a touchpoint (and comfort) for practitioners who have been dealing with (what many consider to be) the overreach of 100A these past years. However, it is unclear what impact the Federal Court’s decision on the Case will have on the guidance or whether the decision will delay its release, which is currently scheduled for February 2022, as the Commissioner still has some time to appeal the decision to the Full Federal Court.

In terms of evidence, the decision underlines once more the importance of presenting the facts entirely and having those facts and witnesses before the court. As much as the legal principles of taxation law are important, the factual matrix cannot be ignored.

As the instructing solicitors for both AIT and Mr Springer, Holding Redlich’s taxation team are very pleased with the Federal Court’s decision. Furthermore, as a bonus, the Federal Court ordered the Commissioner to pay the applicant’s costs on an indemnity basis because the Commissioner failed to accept an offer of compromise sent by our client on 19 June 2020 according to rule 25.14(3) of the Federal Court Rules and the judgment was more favourable to our client than the offer of compromise.

If you have any questions about this article or would like assistance in any tax disputes, please contact a member of our team or send us your enquiry here.

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: