02 November 2022

2 min read

#Corporate & Commercial Law, #Governance

Published by:

If you are a director you need to apply for an Australian Director Identification Number (Director ID) before 30 November 2022. If you were a director but have resigned on or after 4 April 2021, you still need to apply for a Director ID by this date.

With the deadline fast-approaching, we answer some common questions to help you navigate the application process and how you can lodge your application. Find out more about the Director ID regime and its purpose here.

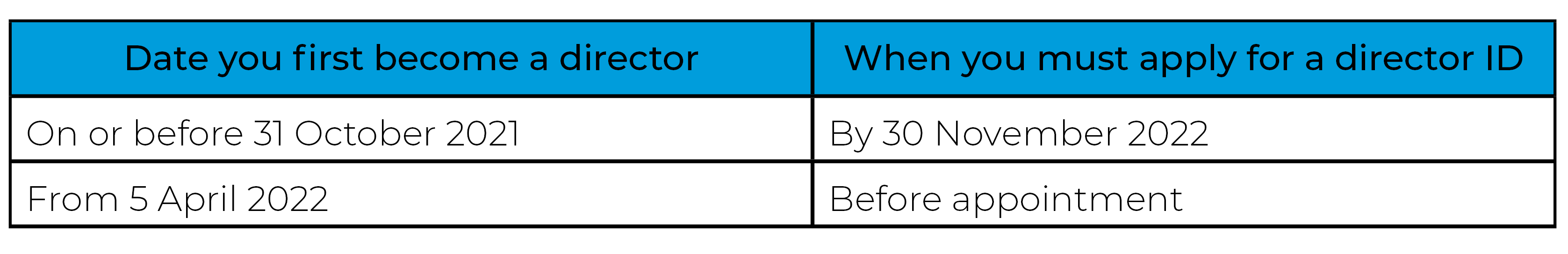

When you must apply for your Director ID depends on when you first became a director of any company, relevantly:

If you are unable to apply for a Director ID within the required timeframe, you can apply for an extension to the Registrar of Australian Business Registry Services (ABRS), by downloading and completing an application form here.

Directors who are living in Australia can apply online for a Director ID through the ABRS website. To apply online, you need to have a myGovID account set up. Alternatively, Australian based directors who are not able to apply online using the myGovID app can call the ABRS and register over the phone (on +61 2 6216 3440).

Directors who are living outside of Australia can download and complete an application form here and provide certified copies of documents that verify your identity.

The ABRS also recently published a new demonstration video to guide directors through the steps needed to apply for their Director ID online.

Your authorised tax, BAS or ASIC agent can help you decide if you need to apply, but they can’t apply on your behalf. Only directors can apply for their own Director ID. The reason you need to apply personally is because you must verify your identity with ABRS. If you use a tax agent, they can assist you with your records, for example, by providing you with your notice of assessment details and bank account details used for ATO refunds.

Yes, a Director ID may still be required. If you are a director that resigned after the new laws came into effect on 4 April 2021, but have since resigned, you should still apply for a Director ID.

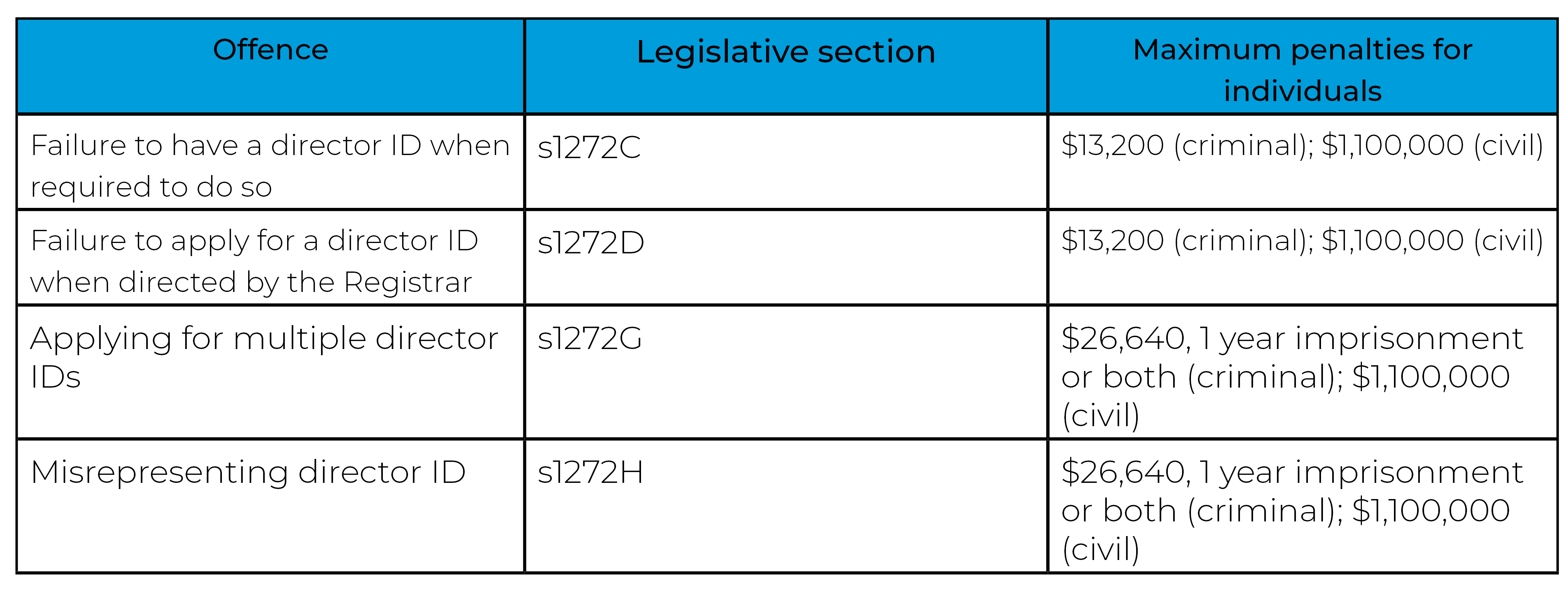

It is a criminal offence if directors do not apply for a Director ID on time, and other significant penalties may apply. These include:

If you have any questions or need assistance with your application, please get in touch with us below or send us your enquiry here.

Disclaimer

The information in this article is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: