Regulatory updates

APRA statement: How super trustees can improve management of outsourcing arrangements (5 October 2022)

APRA outlined the following areas in which trustees could seek to improve their outsourcing processes:

Assessment of services providers:

- when setting the scope of outsourcing services, the process should be:

- trustee-driven, without undue influence from conflicted executives

- broad enough to cover all fund membership.

- the in-depth analysis should:

- use internal and external data and appropriate industry/peer comparison as points of reference

- focus on the value to members through analysis of usage and take-up rates of benefits, services and features.

- robust governance procedures should have:

- clear actions to respond to opportunities to improve value for members

- within the trustee outsourcing policy, documented frequency of reviews undertaken.

Performance measurement and monitoring:

- service provider reporting to trustees should be:

- regular, timely and reliable

- a comparison of actual performance against tolerance for key metrics

- a mixture of dashboards/scorecards and in-depth reporting.

- insights, via discussions, should have:

- insightful, succinct commentary about the quality of services and any identified issues

- include dialogue with service providers to discuss performance or material issues.

- robust governance procedures should have:

- monitoring, oversight and reporting expectations in the trustee’s outsourcing policy

- escalation protocols, documented in the trustee’s outsourcing policy.

Oversight of service providers should have:

- an appropriate delegation framework to set the role in relation to the Board

- a high degree of Board influence on the desired skills and capabilities

- a high degree of Board influence on key performance indicators and remuneration recommendations of staff

- processes to navigate actual and perceived conflicts of interest for related-party outsourcing arrangements

- day-to-day monitoring of outsourcing arrangements, incident management escalation, and collation of performance reporting.

APRA’s recommendations result from a review conducted between February 2019 and October 2021 of 10 retail superannuation trustees. APRA expects that these recommendations should assist all trustees as they evaluate and improve their outsourcing management practices.

APRA frequently asked questions – superannuation heatmaps (5 October 2022)

APRA updated all of its heatmap FAQs, as follows:

- FAQ 1: When will the 2022 MySuper and Choice Heatmaps be released?

- FAQ 2: What data will be used for the 2022 MySuper and Choice Heatmaps?

- FAQ 3: What will be the “as at” date for the December 2022 MySuper and Choice Heatmaps?

- FAQ 4: What investment pathways will be included in the 2022 Choice Heatmap?

- FAQ 5: How do APRA’s heatmaps support the annual performance test?

- FAQ 6: Where can I find MySuper product performance against the annual performance test in the MySuper Heatmap?

- FAQ 7: Does the Heatmap include all MySuper products?

- FAQ 8: How can APRA be confident that the data underpinning the MySuper Heatmap is correct?

- FAQ 9: Which external consultants did APRA use to validate its methodology on MySuper Heatmaps in 2019?

- FAQ 10: Why does the Choice Heatmap include choice products and choice options?

- FAQ 11: Why can’t I find my choice option in the Choice Heatmap?

- FAQ 12: What are APRA’s expectations of RSE licensees where the Choice Heatmap identifies areas of poor performance?

- FAQ 13: Why has APRA included a growth asset allocation category in the Choice Heatmap?

- FAQ 14: Given the wide range of different investment styles and strategies in the choice sector, will APRA apply different benchmarks to different options?

- FAQ 15: What do the heatmaps show?

- FAQ 16: How should the heatmaps be interpreted?

- FAQ 17: Should I use the heatmaps to decide which MySuper product or Choice investment option to invest my retirement savings in?

- FAQ 18: My MySuper product or choice investment option shows up as all/mostly white. Does that mean it is an excellent MySuper product?

- FAQ 19: My MySuper product or choice investment option shows up as mostly orange/red. Does that mean I should choose a different MySuper product, choice option, or move to another superannuation fund?

- FAQ 20: Does the heatmaps cover returns delivered to members?

- FAQ 21: What does APRA mean by sustainability? Why does it matter?

- FAQ 22: Why are there grey cells with no values in the heatmaps?

- FAQ 23: How often will APRA publish the heatmaps?

- FAQ 24: Where can users provide feedback on the heatmaps?

- FAQ 25: How has APRA disclosed products which have adopted the RG 97 requirements?

- FAQ 26: What is the impact on those products that have adopted RG 97 compared to the products that have not adopted the new requirements?

- FAQ 27: Why did APRA use target strategic asset allocation rather than actual asset allocation in one of the reference portfolio benchmarks?

- FAQ 28: How has APRA chosen the growth and defensive allocation split for infrastructure and property assets which have been reported as listed or unlisted?

- FAQ 29: Can APRA disclose the index level data so that calculation can be re-performed?

- FAQ 30: How has APRA ensured that the Heatmap is based on fees gross of tax?

- FAQ 31: Do the heatmaps take into account discounted fees for employer plans?

- FAQ 32: How do the heatmaps adjust for riskiness of assets in assessing investment returns?

APRA statement: Optus data breach (6 October 2022)

APRA released a statement following the Federal Government’s proposed changes to the Telecommunications Regulations 2021 (Cth) in response to the recent Optus data breach. The statement outlines that APRA is working with the Federal Government, other regulators and other relevant bodies to facilitate closer coordination of data sharing between Optus and APRA-regulated entities to increase cybersecurity.

The statement also outlines the following key points if APRA-regulated entities wish to access the data sharing arrangements between APRA and Optus:

- any data shared can only be used for the purposes of implementing enhanced monitoring and safeguards for customers affected by the data breach

- all APRA-regulated financial institutions, excluding branches of foreign banks, are eligible to receive the data should they choose to

- to opt in, entities will be required to provide written attestation to APRA Prudential Standard CPS 234 Information Security, in the context of accessing data from Optus associated with the recent breach

- entities will also need to provide written commitments to ACCC that they will comply with Privacy Act obligations

- APRA, ACCC and relevant bodies are working closely to coordinate the required steps

- once an entity complies with these requests, it will work with Optus to facilitate access to the data.

APRA issues letter to RSE licensees on the revocation of superannuation standards (17 October 2022)

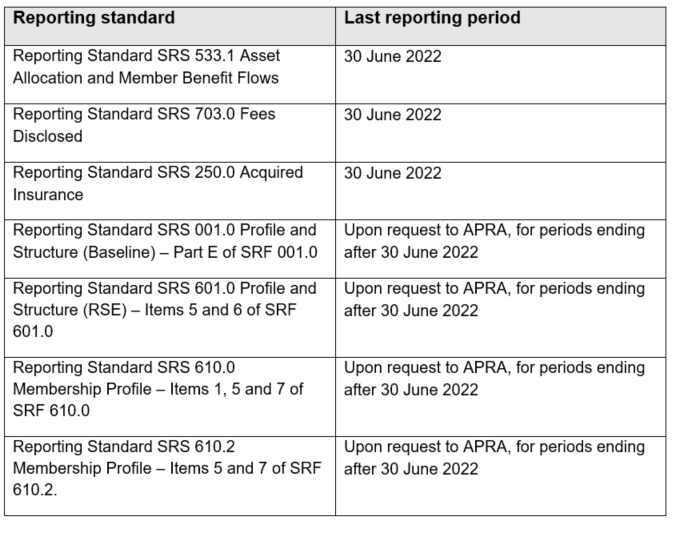

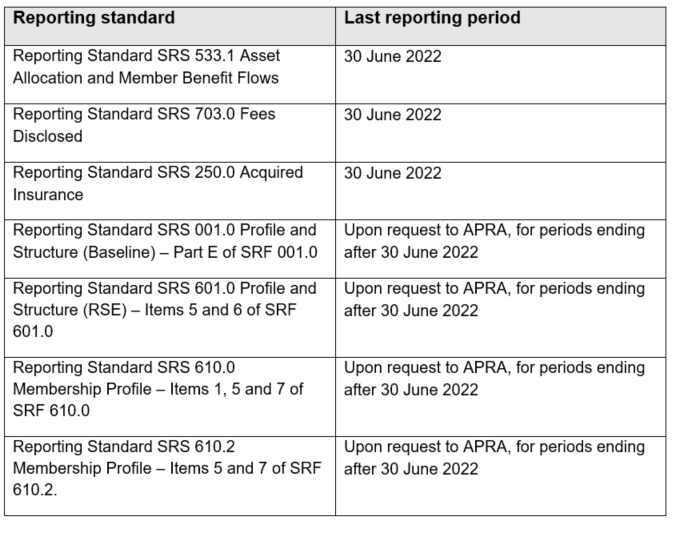

APRA issued a letter to all RSE licensees on the revocation of superannuation standards as part of Phase 2 of the Superannuation Data Transformation (SDT) project. APRA confirms that the following reporting standards will be revoked:

Government Director ID awareness campaign (19 October 2022)

The Federal Government has launched an awareness campaign to help company directors obtain their director identification number (Director ID).

All directors of companies registered with ASIC will require a Director ID and must apply by the 30 November 2022 deadline. See our FAQ here.

APRA statement: New quarterly superannuation industry statistics (20 October 2022)

APRA published its new superannuation statistical quarterly data. The published data includes information on the number and types of products and investment options available in the superannuation industry. The data also includes quarterly statistics on member demographics, such as gender, age and account balances, which were previously only published annually, as well as improved classification of MySuper product asset allocations.

The statement noted the following key insights:

- as at the quarter ending 30 June 2022, there were 69 MySuper products, 956 Choice products and 142 Defined Benefit products with more than four members

- of the $1.95 trillion in member assets held in these products, 41.5% is held in MySuper products, 51% in Choice products and 7.5% in Defined Benefit products

- in the Choice product segment, there were around 10,000 multi-sector investment options, 30,000 single sector investment options and 116,000 direct asset investment options available to members to invest in directly, such as shares or term deposits.

APRA’s FAQs on super data reporting standards (22 October 2022)

APRA published a new FAQ, and updated another, in its Frequently Asked Questions – Superannuation Data Transformation, as follows:

- new FAQ 1.25: When will APRA revoke pre-SDT Reporting Standards that were replaced under Phase 1?

- updated FAQ 1.02: What are the due dates for submission of data under the new reporting standards?

ASIC 2021-22 Cost Recovery Implementation Statement (21 October 2022)

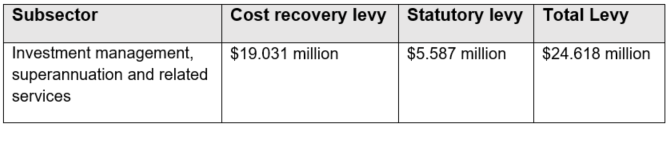

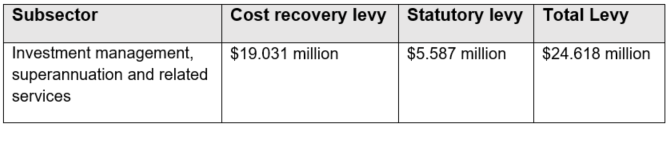

ASIC published its 2021-22 Cost Recovery Implementation Statement, which outlined the following estimated levy for the investment management, superannuation and related services sector:

ASIC statement: Breach reporting and insights from the reportable situations regime (27 October 2022)

ASIC released a statement on information lodged under the reportable situations regime and noted:

- a much smaller proportion than expected of licensees reporting under the regime

- licensees are still taking too long to identify and investigate some breaches

- more work needs to be done to appropriately identify and report the root cause of breaches

- further improvements are needed to licensees’ practices towards remediating impacted customers.

Our comments

The new reporting regime casts a very wide net on what is considered a “reportable situation”, and we gather that most trustees seem to find the new regime difficult when applying it in practice. We recommend that trustees have clear processes in place when working through what is and is not a reportable situation, particularly when a relevant investigation has commenced.

Legislative updates

Social Security Amendment (Family Law – Western Australia De Facto Superannuation Splitting) Determination 2022 (Cth) (7 October 2022)

The Social Security Amendment (Family Law – Western Australia De Facto Superannuation Splitting) Determination 2022 (Cth) (Determination) makes necessary consequential amendments to a number of instruments relating to the valuation of superannuation income streams for the purposes of the social security means test. The Determination ensures amendments made to the Family Law Act 1975 (Cth), which gave effect to a referral of power from Western Australia to the Commonwealth in respect of superannuation matters in family law proceedings, is correctly cross-referenced in relevant subordinate legislation.

Superannuation Guarantee (Administration) Amendment (Aged Care Registered Nurses’ Payment) Regulations 2022 (Cth) (13 October 2022)

The Regulations ensure that an employer is not required to make additional superannuation contributions as a result of a payment made to an employee under the Aged Care Registered Nurses Payment Grant (Grant). The Regulations achieve this by exempting payments made to an employee under the Grant from being included in the “salary or wages” that are used to calculate an employer’s superannuation guarantee charge.

Superannuation Funds Management Corporation of South Australia (Investment in Russian Assets) Amendment Act 2022 (SA) (18 October 2022)

The Superannuation Funds Management Corporation of South Australia (Investment in Russian Assets) Amendment Act 2022 (SA) (the Act) amended the Superannuation Funds Management Corporation of South Australia Act 1995 (SA) (SA Superannuation Corporation Act) to ensure ministerial directions can direct the Superannuation Funds Management Corporation (Funds SA) to divest Russian assets. Before the Act’s assent, there was no ministerial power to direct Funds SA to divest Russian assets.

SGR 2009/2A2 – Addendum (19 October 2022)

The Addendum amends Superannuation Guarantee Ruling SGR 2009/2 to reflect the repeal and replacement of the Superannuation Guarantee (Administration) Regulations 1993 (Cth) with the Superannuation Guarantee (Administration) Regulations 2018 (Cth). The Addendum also reflects changes made to subsection 27(2) of the Superannuation Guarantee (Administration) Act 1992 (Cth) (SGAA). Section 27 of the SGAA specifies salary or wages that are not to be taken into account for the purposes of calculating an individual superannuation guarantee shortfall.

Cases and other recent developments

H.E.S.T Australia Ltd v Attorney-General (Qld) & Anor; Mercy Super Pty Ltd v Attorney-General (Qld) [2022] QSC 221

The Queensland Supreme Court granted declaratory orders to HESTA and Mercy that their proposed successor fund transfer (SFT) was not caught under the scope of a “substituted appointment” under section 442F of the Criminal Code Act 1899 (Qld) or section 180 of the Crimes Act 1958 (Vic) (HESTA Case).

Since the BT Funds Management Limited (ACN 002 916 458) as trustee for the Retirement Wrap Superannuation Fund [2022] NSWSC 401 (BT Case), there has been industry concern on the interpretation of corrupt benefit provisions, including ordinary indemnification provisions seen in SFT deeds. The relevant corrupt benefit provisions include:

- NSW – section 249E of the Crimes Act 1900 (NSW)

- Victoria – section 180 of the Crimes Act 1958 (VIC),

- Qld – section 442F of the Criminal Code Act 1899 (QLD)

- Western Australia – section 535 of the Criminal Code Act Compilation Act 1913 (WA),

(collectively, Corrupt Benefit Provisions).

The HESTA Case held that SFTs are not caught under the Queensland and Victorian Corrupt Benefit Provisions on the basis that a SFT does not constitute the “substituted appointment” of a trustee, but rather the transfer of assets and members from one trust to a different trust.

Our comments

Publicly, the HESTA Case appears to have been viewed as a success. However, we note this case did not address the New South Wales Corrupt Benefit Provision and does not provide a resolution to the BT Case.

When examining both the BT Case and HESTA Case, it is our view that:

- the HESTA Case provides clarity that SFTs are not caught by the Queensland and Victorian Corrupt Benefit Provisions, as they do not meet the threshold requirement of being considered a substituted appointment

- the HESTA Case made no declarations in respect of the New South Wales and Western Australian Corrupt Benefit Provisions

- there is no guarantee that the New South Wales Court would follow the HESTA case given that the New South Wales Corrupt Benefit Provision is drafted more broadly when compared to the other Corrupt Benefit Provisions.

If you have any questions about this update, please contact us below or send us your enquiry here.

Authors: Luke Hooper & Michael O’Connor

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Share this