18 May 2025

7 min read

Published by:

The recent judgement of the Supreme Court of New South Wales (the Court) in Lendlease Communities (Figtree Hill) Pty Ltd v Mount Gilead Pty Ltd (No 3) [2025] NSWSC 334 (Mount Gilead No 3) serves as a cautionary reminder that strict adherence to the conditions precedent is required when exercising a put or call option. Otherwise, the right to exercise that option will not arise.

The proceedings concerned an agreement entitled ‘Irrevocable Offers Deed Balance Land, Mt Gilead’ (Deed) for the purchase of Lots 6 to 10 (Balance Land) entered between the plaintiff and members of the Lendlease group (Lendlease) and Mount Gilead Pty Limited and Mount Gilead (Access) Pty Ltd (together, the Landowners).

The Landowners owned land at Campbelltown (the Land), which was previously part of a larger property, also owned by them. Lendlease had already developed some of the Land, known as Figtree Hill, under a plan of subdivision comprising Lots 1 to 5.

As noted, the Deed contemplated Lendlease purchasing Lots 6 to 10. However, Lendlease subsequently decided to only purchase Lots 7 to 10, which lead to the dispute.

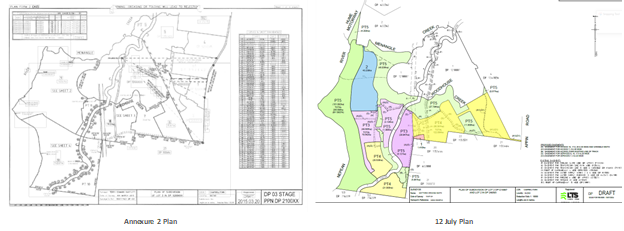

To exercise their option, Lendlease was required to provide the Landowners with a subdivision plan ‘based upon’ the draft plan of subdivision at Annexure 2 of the Deed (Annexure 2 Plan), but could be ‘varied’ in accordance with certain provisions of the Deed.

The proceedings turned on whether Lendlease’s plan of subdivision for lots 7 to 10 constituted a plan of subdivision as required under the Deed. If so, was Lendlease entitled to exercise their option to purchase the lots?

In essence, the Deed set out a ‘carefully prescribed framework for the sequential and interdependent acquisition [of the Balance Land] by Lendlease through put and call options’ as follows:

This framework included the Annexure 2 Plan which showed the Balance Land as being subdivided into 5 lots, numbered 6 to 10. As part of the requirements for exercising a call option, Lendlease was required to serve a plan of subdivision on the Landowners.

On 12 July 2024, Lendlease served a plan of subdivision on the Landowners (12 July Plan), positing that the Landowners were now required to use their best endeavours to obtain Council’s approval for that plan. The 12 July Plan differed from the Annexure 2 Plan and this difference was the key point of contention.

The two plans are set out below:

[Images sourced from Annexure 2 Plan and 12 July Plan in Lendlease Communities (Figtree Hill) Pty Ltd v Mount Gilead Pty Ltd (No 3) [2025] NSWSC 334]

The Landowners contended that the 12 July Plan was not ‘based upon’ the Annexure 2 Plan. Therefore, the Landowners had no obligation to, and Lendlease was not entitled to, lodge the 12 July Plan with Council for approval.

If the Landowners were correct, it would be too late for Lendlease to re-submit another plan due to the time constraints specified in the Deed, meaning Lendlease had lost the right to compel the Landowners to sell.

Whether Lendlease could acquire Lots 7 to 10 primarily turned on whether the 12 July Plan was a ‘Plan of Subdivision (Balance Land)’: a plan based upon the Annexure 2 Plan.

On a proper construction of the definition of Plan of Subdivision (Balance Land), the Court determined:

The 12 July Plan only provided for the subdivision of the Balance Land into 4 lots, corresponding to Lots 7 to 10, rather than the 5 lots contemplated by the Annexure 2 Plan.

The 12 July Plan also significantly altered the Lots’ size and boundaries, with Lot 1 in the Annexure 2 Plan, corresponding to lot 6, being 35.6 hectares in the Annexure 2 Plan and only 1.41 hectares in the 12 July Plan. Although the 12 July Plan still ‘included’ Lot 6, it was significantly smaller and could no longer be said to be based upon the Annexure 2 Plan.

The parties’ intention for Lendlease to have the power only to vary the boundaries in ‘more than 5 lots’ was indicated by clause 7.6(a)(ii). These lots were to correspond with properties 6 and 10, suggesting they were to remain contiguous. This was no longer the case as there were only 4 lots contained in the 12 July Plan. The 12 July Plan was therefore ‘fundamentally different’ to the Annexure 2 Plan.

As a matter of fact, the 12 July Plan no longer resembled the Annexure 2 Plan. It was not ‘based upon’ it, meaning Lendlease had not complied with its obligations under clause 7.1 of the Deed to provide the Landowners with a Plan of Subdivision (Balance Land). Lendlease was no longer entitled to lodge the 12 July Plan with Council and had lost its right to do so going forward.

Lendlease admitted that due to the time constraints of the Deed, they could no longer acquire Lot 6. This is because lot 6’s sale off period had expired. Completion of lot 6 was now impossible.

The Landowners argued that Lendlease had therefore lost their right to purchase the remaining lots: as Lot 6 could not complete, neither could the remaining lots. This is because the Key Reference Schedule of the Deed sequentially detailed the date for completion of each of the lots, being 11, 35, 59 and 83 months ‘after the completion of Contract 6’.

Neither could the Landowners’ ‘Purchaser Offer Period’ commence, as the period ‘commence[ed] on the same date as the property 6 Sale Offer Period’. This indicated that the parties intended for the sale to be each Lot, 6 to 10, and in that sequence.

The Court construed that Lot 6 was part of a ‘sequential disposal’ by the Landowners of Lots 6 to 10. The Deed contemplated the sale of each, being every one of, not any one of, the lots was irrevocable. Lendlease could not ‘pick and choose’ which of the Lots 6 and 10 was the subject of the sale offer.

As Lendlease could not acquire Lot 6, it no longer entitled to acquire the remaining lots.

Since Lendlease failed to meet the conditions precedent, including providing the Landowner with a Plan of Subdivision (Balance Land) that was ‘based on’ the Annexure 2 Plan within the required period specified under the Deed, it could not exercise its option to purchase lots 7 to 10.

This case serves as an important reminder that parties must strictly adhere to the method of exercising an option, or face losing the right to exercise their option altogether. Parties must follow the conditions precedent step by step for their rights to arise.

Practitioners also need to be cautious when drafting put and call option agreements. Using broad terms, such as ‘based upon’, may leave the agreement open to interpretation and construction by the courts, as was the case in these proceedings.

If you have any questions about this article or need legal assistance with preparing a put and call option agreement, please get in touch with our team below.

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this newsletter is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: