26 November 2023

5 min read

Published by:

"It is the dream of many, to pack bags, and come to Bali in order to leave behind the old life and settle on this beautiful island. A dream, that thousands of self-employed digital nomads and remote workers have made come true in recent years".

*extract from the website Bali.com

In the aftermath of the COVID-19 pandemic, the newfound flexibility and mobility of employees, coupled with the rapid advancements in technology, have opened doors to remote working. However employers may well find that Australian labour laws still apply to the digital nomads on their payroll.

Further, these arrangements can impact upon the employers’ tax obligations (click here to see our article ‘Tax considerations for mobile and remote workforces’).

The Fair Work Act 2009 (Cth) (FW Act) will apply outside the territorial limits of the Commonwealth, in connection with ‘Australian employers’ and ‘Australian-based employees’.

An Australian-based employee is an employee whose primary place of work is in Australia and is employed by an Australian employer.

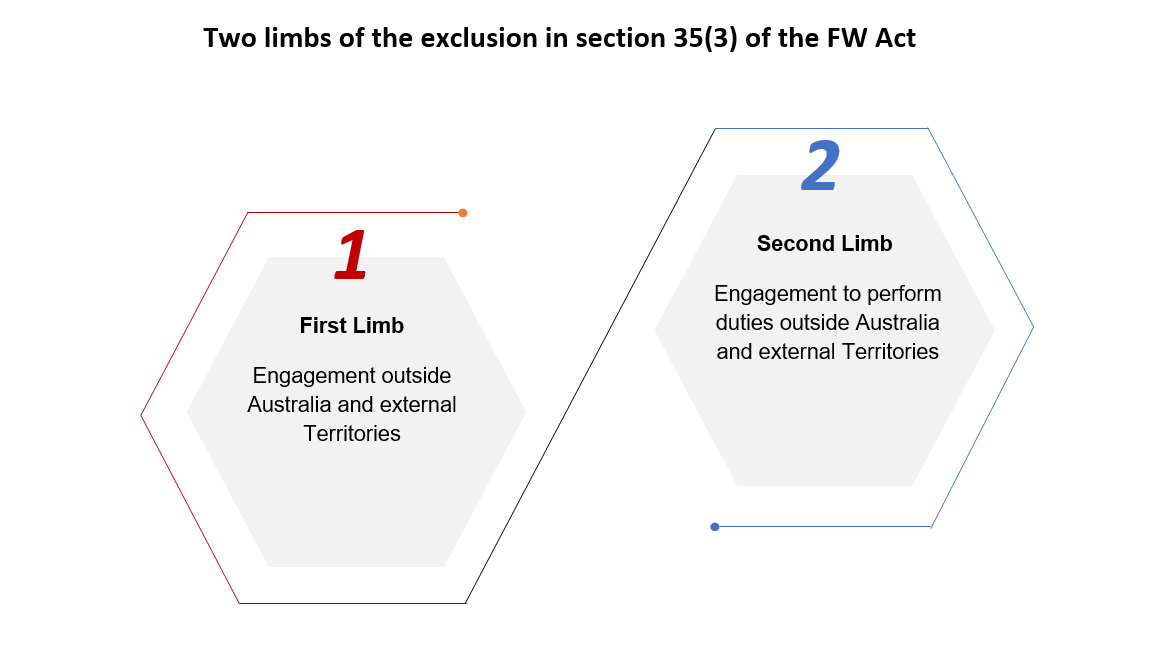

Pursuant to section 35(3) of the FW Act, the FW Act will not apply if:

The first element (a) is resolved by the place where the employment contract is made. The second element is resolved by the place where the employee is obliged to perform work under the employment contract.

In the case of Gautam Parimoo v Lake Resources N.L [2023] FWC 2543 (Parimoo), the Fair Work Commission (FWC) dealt with a U.S. citizen born in India who was recruited for the position of Chief Operating Officer by an Australian public company to perform work as a Project Director in a lithium mine in Catamarca, Argentina. The company had its principal office in Sydney.

The recruitment process involved several online interviews conducted between the worker (who attended from overseas via an online video conferencing platform) and employees of the company (who attended from Sydney and Perth).

An employment agreement was electronically signed by the worker and returned by email to the Sydney office. The agreement expressly stated that it was to be governed and construed in accordance with the laws of New South Wales, Australia.

In January 2023, the worker was dismissed, effective immediately, with payment in lieu of notice. The worker lodged a general protections application with the FWC.

The company raised a jurisdictional objection to the application on the basis that the worker was not an ‘Australian-based employee’ entitled to protection under the general protections regime of the FW Act.

In this case, the worker’s duties under his contract were to be performed wholly in Argentina. The question before the FWC was whether the worker could have said to have been ‘engaged outside Australia’ as required by the first element of the exemption.

To answer this question, the FWC applied the ordinary rules governing the formation of contracts, namely:

Further, the FWC considered that the Electronic Transactions Act 2000 (NSW) (ET Act) applied to the formation and the making (including acceptance) of the employment contract.

Relevantly, section 13B of the ET Act states that, unless the parties agree otherwise:

The ET Act does not stipulate what the place of formation of a contract entered into by email is (i.e. whether it is where the acceptance was dispatched, where it arrives in the mail-box of the offeror, or where the offeror actually reads the email).

However, case law has adopted the view that the place of formation of a contract accepted by email is the place where the offeror receives the email (Australian Competition and Consumer Commission (ACCC) v Valve Corp (No 3) (2016) 337 ALR 647 at [78]-[82] and Olivaylle Pty Ltd v Flottweg GMBH & Co KGAA (No 4) (2009) 255 ALR 632 at [25]).

This position was upheld in the case of Winter v GHD Services Pty Ltd [2019] FCCA 775, where an employee signed his employment contract in the U.S. and returned the signed copy of the contract to his employer by email. The Court held that acceptance did not occur at the time of signing, but at the time and the place that such acceptance was electronically communicated to the employer at its registered business address, in Canberra.

In Parimoo, the FWC, applying the principles above, ruled the employer’s employment offer was not accepted until the worker’s acceptance was communicated to the employer. This was done by the employee emailing the signed copy of the employment contract to the employer at its registered business address in Canberra. The contract of employment was made in Australia and the applicant was as an Australian-based employee employed by an Australian employer. Accordingly, the general protections application fell within the jurisdiction of the FWC.

This issue was considered in Infosys Technologies v Victoria [2021] VSCA 219 by the Victorian Court of Appeal for the purposes of Victorian long service laws. The Court ruled that only the employment with a continuous connection with Victoria should give rise to a long service leave entitlement under Victorian legislation. Employment outside Victoria could only have that connection if the employee worked under directions emanating from Victoria or where the employment first started in Victoria. Given that, before the employees transferred to Victoria, their employment had no relevant connection with Victoria, so the employees’ long service leave entitlement could only arise based on the service they had in Victoria.

While this decision concerns Victorian long service leave legislation, it has implications for all state and territory legislation dealing with this entitlement.

Conclusion

The decisions in Parimoo and Infosys underscore the need of a nuanced approach to jurisdictional matters in the context of workers engaged to perform work overseas. Employers should proactively reassess whether Australian labour laws may apply to certain employees whom they previously believed fell outside its purview to ensure adherence to relevant legal frameworks and mitigate the risks associated with claims falling under an Australian jurisdiction.

Published by: