08 June 2021

7 min read

ASIC statement on ‘general advice’ label (4 May 2021)

ASIC released its consumer research findings, stating that it will not recommend the Government to change the label of ‘general advice’. The consumer research was initially commissioned in response to the Financial System Inquiry Final Report and the Productivity Commission Inquiry Final Report into Competition in the Australian Financial System. ASIC stated that the consumer research found:

“…no evidence to suggest that changing the general advice label, including adding the word ‘only’ to the general advice label, will have any measurable effect on consumers’ perceptions about the nature of the advice given. This includes perceptions about the personalisation of the advice, understanding of the advice provider’s obligations and the importance of seeking further information.”

ASIC’s key findings were:

ASIC recommends AFS licensees familiarise themselves with Regulatory Guide 244 Giving information, general advice and scaled advice.

Updated unclaimed superannuation money protocol (7 May 2021)

Treasury has updated its guidance on the unclaimed superannuation money protocol for obligations under the Superannuation (Unclaimed Money and Lost Members) Act 1999 (Cth) (SUMLM Act). The updates include information and examples on the following topics:

Further information can be found on the ATO website.

2021 Federal Budget (11 May 2021)

On 11 May, the Treasurer announced the following proposed changes that impact superannuation:

Proposed financial institutions supervisory levies for 2021-22 (18 May 2021)

Treasury released a discussion paper proposing increases to the financial institutions supervisory levies for the 2021-2022 financial year.

APRA’s 2021-22 levy funding requirements have increased from the previous financial year to $225.8 million, a $29.6 million (15.1%) increment.

The $95.5 million superannuation levies funding consists of $57.8 million for APRA’s supervision of the superannuation industry and $37.6 million for costs relating to ASIC, ATO and Gateway Network Governance Body Ltd. This total compares to $82.1 million in 2020-21.

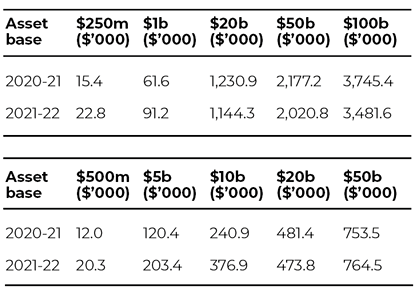

Proposed levies for superannuation funds (excluding PSTs) are set out below.

Submissions are due by 11 June 2021.

APRA FAQ – Superannuation Data Transformation update (21 May 2021)

APRA has further updated its FAQ’s on data transformation designed to clarify reporting issues raised by trustees. The FAQs cover reporting dates for the submission of data and questions on APRA Reporting Standard SRS 605.0 RSE Structure.

Superannuation funds should revisit APRA’s FAQs to familiarise themselves with the new updates.

Financial Regulator Assessment Authority Bill 2021 introduced (13 May 2021)

The Bill was introduced into the House of Representatives and seeks to respond to the Financial Services Royal Commission and, in particular, addresses:

The Bill proposes the creation of the Financial Regulator Assessment Authority to assess both the effectiveness and capability of APRA and ASIC, however, the Bill does not define what either “effectiveness” or “capability” entails.

Financial Sector Reform (Hayne Royal Commission Response – Advice Fees) Regulations 2021 (14 May 2021)

The Regulations Financial Sector Reform (Hayne Royal Commission Response – Advice Fees) Regulations 2021 have been made to support Financial Sector Reform (Hayne Royal Commission Response No 2) Act 2021 (Cth). The regulations outline that records must be kept for compliance with ongoing fee arrangements.

Statutes Amendment (Fund Selection and Other Superannuation Matters) Act 2021 (SA) (20 May 2021)

The South Australian Act allows public servants to choose their preferred superannuation fund. Previously, members of the state’s Triple S Superannuation Scheme administered through Super SA had been mandatory for public servants.

Treasury Laws Amendment (Measures for Consultation) Bill 2021: Requirement for actuarial certificates for certain superannuation funds (21 May 2021)

Treasury released proposed legislation seeking to amend the Income Tax Assessment Act 1997 (Cth) (ITAA 1997) that will remove the requirement for trustees to obtain an actuarial certificate when calculating exempt current pension income for members who are in the retirement phase for the entirety of the income year. The purpose of the amendment is to reduce the cost of red tape.

Submissions are due by 18 June 2021.

Treasury Laws Amendment (Measures For Consultation) Bill 2021: Providing choice for trustees calculating exempt current pension income (21 May 2021)

Treasury released proposed legislation seeking to amend the ITAA 1997 to allow trustees to choose their preferred method of calculating exempt current pension income when they have member interests in both accumulation and retirement phases at one time, but only retirement phase interests at another time, during an income year.

Submissions are due by 18 June 2021.

Extension on the temporary reduction in superannuation minimum drawdown rates (29 May 2021)

The Government proposes to extend the 50% reduction minimum drawdown rates for the 2021-22 financial year, which was introduced in 2020 due to the COVID-19 pandemic.

Treasury Laws Amendment (Measures for Consultation) Bill 2021: Superannuation information for family law proceedings (31 May 2021)

Treasury released proposed legislation seeking to amend the Family Law Act 1975 (Cth) and Taxation Administration Act 1953 (Cth) to improve the visibility of superannuation assets in family law proceedings. Changes include leveraging information held by the ATO to facilitate the identification of superannuation assets.

The exposure draft legislation provides the ATO authority to disclose superannuation information to court registry staff for relevant family law proceedings.

Submissions are due by 28 June 2021.

21-096MR ASIC bans former Sydney adviser for eight years (6 May 2021)

ASIC has banned a Sydney-based former financial adviser from providing financial services for eight years.

ASIC determined that the adviser falsely witnessed the signing of binding death benefit nomination forms for 17 clients, backdated documents, and falsified a client’s signature on certain documents.

21-115MR ASIC sues AMP for charging deceased customers (27 May 2021)

ASIC commenced proceedings against five companies that are either presently or were formally associated with AMP Limited Group. The alleged conduct involved charging insurance premiums and advice fees to deceased customers despite being notified of their death.

ASIC alleges the companies did one or more of the following:

ASIC further alleges that the overall conduct of the companies was in all circumstances unconscionable.

The proceeding will be listed for a case management hearing on a date yet to be set.

Authors: Luke Hooper & Michael O'Connor

DisclaimerThe information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this update is accurate at the date it is received or that it will continue to be accurate in the future.