Regulatory Updates

APRA frequently asked questions – Superannuation Data Transformation (3 to 19 December 2021)

APRA released six frequently asked questions (FAQs) to provide further guidance to trustees for phase 1 of the Superannuation Data Transformation (SDT) project. The new FAQs are:

- FAQ 1.0: What data is required for the historical data collection and what are the due dates for submission of data under the SDT reporting standards?

- FAQ 1.1: When will the returns for the historical data collection be allocated in APRA Connect?

- FAQ 1.2: How will the historical data collection be allocated in APRA Connect, will these be a consolidated report or separate returns?

- FAQ 1.3: What insurance arrangements require historical data to be reported under the SDT reporting standards?

- FAQ 1.4 4: What is the due date for RSE licensees to submit historical data required under SRS 251.0?

- FAQ 1.5: What products, investment menus and investment options require historical data to be reported under the SDT reporting standards?

- FAQ 1.19: When reporting an ad-hoc submission (for SRF 251.3, SRF 605.0 or SRF 706.0) should the RSE licensee report data for the entire reporting form, or report the data that has changed on the reporting form?

- FAQ 1.20: What is the process for resubmitting a reporting form in APRA Connect?

- FAQ 1.21: When does APRA intend to consult on the publication and confidentiality treatment of the data reported under the new reporting standards from phase 1 of the SDT program?

- FAQ 1.22: When does APRA intend to begin consulting on phase 2 of the SDT program?

- FAQ 550.0a: Under APRA’s framework, how should effective exposure be calculated for options and all other derivatives?

- FAQ 605.0t: How should standard fee and cost arrangements be reported in SRF 605.0 table 4?

ASIC review of super trustees offering default income protection insurance (10 December 2021)

ASIC published its findings from a review of the provision of default income protection cover by five trustees.

ASIC’s review found that:

- a variation in the types of income that were offset against IP benefits

- welcome pack and website disclosures about offset clauses were incomplete and difficult to understand

- no evidence that the trustees had rigorously analysed how their offset clauses affect member outcomes.

Addressing these findings, ASIC recommends trustees:

- obtain and analyse data, including from their insurer, to assess how offsets affect member outcomes, including whether some groups of members are receiving low or no value

- improve the extent and quality of disclosures to members relating to IP offsets, especially when a member’s IP insurance will pay a reduced benefit

- clearly explain to their members how ‘offset’ clauses work so that members can make informed decisions about their insurance.

APRA publishes MySuper and Choice Heatmaps (16 December 2021)

APRA published its 2021 MySuper and Choice Heatmaps with the below key insights.

MySuper Heatmap:

- 45% of MySuper products (31 out of 69) delivered returns below APRA’s Heatmap benchmarks

- 22 MySuper products have closed since the release of the first MySuper Heatmap, including three that failed the 2021 Your Future, Your Super performance test

- investment returns are the primary driver of underperformance

- fees and costs for MySuper products are declining, but there remains considerable scope for further reductions.

Choice Heatmap:

- 60% of investment options in the Choice Heatmap delivered returns below APRA’s Heatmap benchmarks over seven years, with over 25% of options delivering significantly poor return

- performance of choice products varies considerably more than MySuper products

- choice product fees and costs are considerably higher than MySuper products, without obvious benefit in financial outcomes for members.

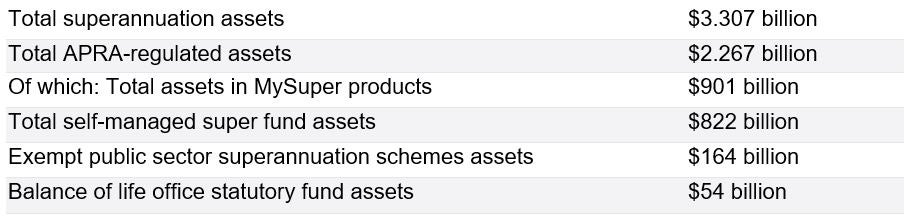

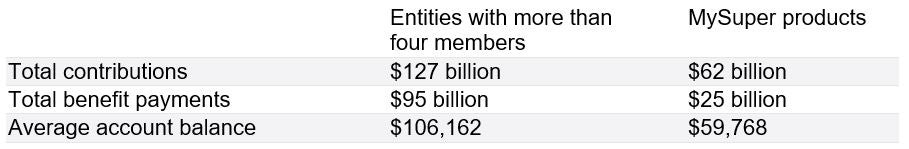

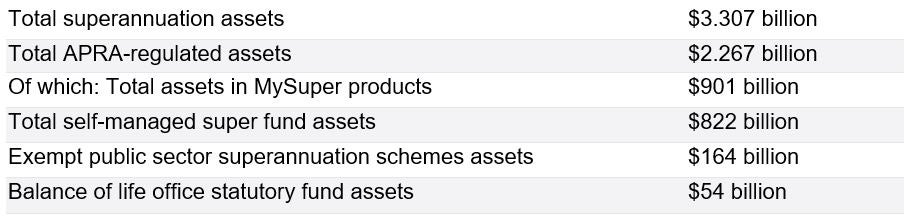

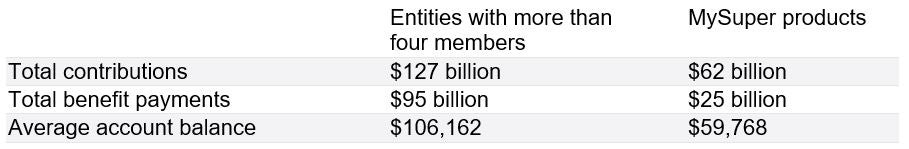

APRA Annual Superannuation Bulletin for the 2020/21 financial year (31 January 2022)

APRA has released its key superannuation statistics for the 2021 financial year, which includes:

Key statistics for the superannuation industry as at 30 June 2021

Key statistics for entities with more than four members for the year ended on 30 June 2021

Legislative Updates

Treasury Laws Amendment (2021 Measures No. 5) Act 2021 (7 December 2021)

The Act received royal assent on 7 December 2021 and incorporates minor technical amendments to section 120 of the SIS Act so that the appointment of a restructuring practitioner is considered to be an insolvency event that triggers the disqualification of a trustee, custodian or investment manager from managing a superannuation entity.

The Act also amends the Superannuation (Unclaimed Money and Lost Members) Act 1999 (Cth) (SUMLM Act) to:

- enable the Commissioner of Taxation to recover overpayments

- ensure that New Zealand-sourced amounts held under the SUMLM Act are treated consistently with the rules in Part 12A of the SIS Regulations, which sets out matters to implement the Trans-Tasman retirement savings portability scheme for individuals. In other words, KiwiSaver-sourced superannuation amounts transferred to the Commissioner of Taxation, under the SUMLM Act, can be paid to New Zealand KiwiSaver scheme providers.

Amendments to Prudential Standard SPS 310 Audit and Related Matters (10 December 2021)

APRA released, for consultation, its proposed amendments to APRA Prudential Standard SPS 310 Audit and Related Matters (SPS 310) to align with changes to APRA’s reporting standards for superannuation. The proposed changes include:

- removing the requirement for auditors to review the following APRA Reporting Standards:

- SRS 530.0 Investments

- SRS 531.0 Investment Flows

- SRS 330.2 Statement of Financial Performance

- SRS 533.0 Asset Allocation (in respect of MySuper investment options only)

- SRS 540.0 Fees

- SRS 702.0 Investment Performance (in respect of MySuper investment options only)

- SRS 703.0 Fees Disclosed (in respect of MySuper products only).

- require assurance over the following six new reporting standards:

- Reporting Standard SRS 550.0 Asset Allocation

- Reporting Standard SRS 550.1 Investments and Currency Exposure

- Reporting Standard SRS 705.0 Components of Net Return

- Reporting Standard SRS 705.1 Investment Performance and Objectives

- Reporting Standard SRS 706.0 Fees and Costs Disclose

- Reporting Standard SRS 332.0 Expenses.

Submissions are due by 11 March 2022.

Treasury Laws Amendment (Greater Transparency of Proxy Advice) Regulations 2021 (16 December 2021)

The Regulations amend the SIS Regulations to expand the range of information that trustees must make publicly available on their funds’ websites to include a summary of how voting rights attached to shares in listed companies that the trustee holds have been exercised.

Superannuation Legislation Amendment (Western Australia De Facto Superannuation Splitting) Regulations 2021 (16 December 2021)

The Regulations support the Family Law Amendment (Western Australia De Facto Superannuation Splitting and Bankruptcy) Act 2020 (Cth) (WA Superannuation Splitting Act) by ensuring that any provisions in regulations governing superannuation splitting under the Family Law Act 1975 (Cth) also apply to superannuation splits made by de facto couples in Western Australia.

Treasury Laws Amendment (Miscellaneous and Technical Amendments No. 2) Regulations 2021 (16 December 2021)

The Regulations extends to pooled superannuation trusts to provide annual reports on their websites, which were previously only available to regulated superannuation funds. The Regulation also exempts trustees from specific reporting requirements for periodic statements when the following circumstances apply:

- superannuation products that are non-investment or accumulation life insurance policies offered through the regulated superannuation fund

- superannuation products that have no investment component

- periodic statements relating to a reporting period that starts at the end of a preceding reporting period and ends when the holder of a financial product ceases to hold the product.

Cases and other recent developments

Trustee fee cases

Nine trustees, over December and January, made separate applications to courts in different states seeking either judicial advice or court orders enabling the trustees to amend various trust deeds (in various manners) in order to ensure that they could charge trustee fees, in response to the changes to sections 56 and 57 of the SIS Act, which took effect as of 1 January 2022.

Despite the differences in jurisdictions, particular fact scenarios and questions asked of the different courts, the following could be regarded as being consistent in most, if not all, cases:

- the proposed amendments to charge a trustee fee, whether drafted broadly or narrowly to address the risk of insolvency, is clearly not caught under the scope of indemnification and, therefore, not caught by sections 56 and 57 of the SIS Act

- when proposing to introduce a new trustee fee, the best financial interests of members is to be considered, and this requires a broad interpretation of whether the trustee is “reasonably justified” in concluding the proposed amendments are in the best financial interests of members

- trustees were successful in establishing the trustee fee was in the best financial interests of members because they provided evidence of the following considerations:

- there is a clear detriment to beneficiaries if the trustee was to go insolvent

- there has been a significant increase in the potential for, and quantum of, fines and civil penalties for contraventions of Chapter 7 of the Corporations Act

- there is a higher risk of civil penalties for contravention of the trustee covenants in sections 52 and 52A of the SIS Act

- APRA and ASIC have indicated an active enforcement agenda with respect to regulated superannuation funds post the Hayne Royal Commission

- the obligation that the power to charge a trustee fee still requires the trustee to comply with its duties under the trust deed, statute and general law

- other options and factors had been considered, including the availability and scope of insurance for the trustee and directors when permitted under law

- the reasonableness of the trustee fee proposed and cap

- the impact of members to charge a fee and how the fee may be structured to minimise impact.

ASIC brings criminal charges against Avanteos Investments for charging deceased superannuation members (8 December 2021)

Avanteos Investments Limited (Avanteos) pleaded guilty to 18 criminal charges relating to failures to update defective disclosure statements and continuing to charge fees to deceased superannuation members.

In early 2016, Avanteos received legal advice that it did not have the authority to deduct fees from superannuation members after their death. Despite this, Avanteos did not update its disclosure statements and between 6 January 2016 and 1 May 2018, disclosure statements for 18 superannuation products issued by Avanteos were defective as they failed to tell superannuation fund members they would be charged adviser service fees after their death.

As a result of the offending, 499 deceased members with funds in these superannuation products were charged almost $700,000 in fees by Avanteos when it was not entitled to do so. Avanteos has remediated all affected customers.

This matter is the first criminal prosecution under section 1021J(1) of the Corporations Act. It is an offence for the preparer of a disclosure document or statement to not take reasonable steps to ensure that a defective disclosure document is not distributed or is not accompanied by information that corrects the deficiency.

The matter is next listed for sentencing on 1 June 2022.

Our comments

There is often a fine line between the marketing and compliance side of a disclosure document. This case demonstrates that compliance must come first in all cases.

ASIC sues OnePath for fees for no service misconduct (15 December 2021)

ASIC has commenced civil penalty proceedings in the Federal Court against superannuation trustee OnePath Custodians Pty Ltd (Trustee) for allegedly charging fees for no service and making false and misleading representations to fund members.

The particular conduct alleged includes:

- misleading, deceptive and false conduct in which the Trustee:

- engaged in misleading or deceptive conduct within the meaning of section 12DA(1) of the ASIC Act, and

- made representations that were false or misleading within the meaning of sections 12DB(1)(g) and (i) to both certain members.

- failures to provide financial services efficiently, honestly and fairly. The Trustee failed to do all things necessary to ensure that the financial services covered by its AFSL were provided efficiently, honestly and fairly, and is in breach of section 912A(1)(a) of the Corporations Act by:

- deducting adviser service fees from members not receiving advice (No-Adviser Members), where those deductions and payments were unauthorised, contrary to the relevant contractual terms and in breach of trust

- failing to inform No-Adviser Members that the Trustee was not entitled to make the deductions and the No-Adviser Members were not obliged to pay the adviser service fees

- failing to inform members who had ‘delinked’ from an Employer Plan (Previously Linked Members) that they had the right to unilaterally terminate the adviser service fee

- issuing annual statements and delinking letters that contained false and misleading representations

- deducting adviser service fees from the accounts of Previously Linked Members and paying those deductions to the plan adviser assigned to the Employer Plan from which the Previously Linked Member had been delinked.

The date for the first case management hearing is yet to be scheduled by the Court.

Authors: Luke Hooper & Michael O’Connor

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Share this