12 February 2020

7 min read

Published by:

Recent cases provide guidance on how to calculate an employee’s annual rate of earnings

A common vexed question for employers is whether an employee’s earnings exceed the ‘high income threshold’ for the purpose of eligibility to bring an unfair dismissal claim under Part 3-2 of the Fair Work Act 2009 (Cth) (FW Act).

The high income threshold is currently $148,700 per annum (adjusted effective 1 July annually). Employees whose earnings, made up of their ‘annual rate of earnings’ and ‘other amounts’ prescribed by the Fair Work Regulations 2009 (Cth) (FW Regulations), exceed the ‘high income threshold’ will not be eligible to bring an unfair dismissal claim, unless they are also covered by a modern award or an industrial instrument such as an enterprise agreement (section 382(b)(iii) of the FW Act). This means that an employee who earns in excess of the high income threshold, but is still covered by a modern award or industrial instrument, may still be protected from unfair dismissal.

In this article, we review the relevant provisions and cases which inform whether an amount or benefit should be included in a calculation of an employee’s earnings for the purpose of determining eligibility for unfair dismissal.

Calculating an employee’s earnings

Under section 382(b)(iii) of the FW Act, a person is protected from unfair dismissal if the sum of their ‘annual rate of earnings’ and ‘other amounts’ is less than the high income threshold.

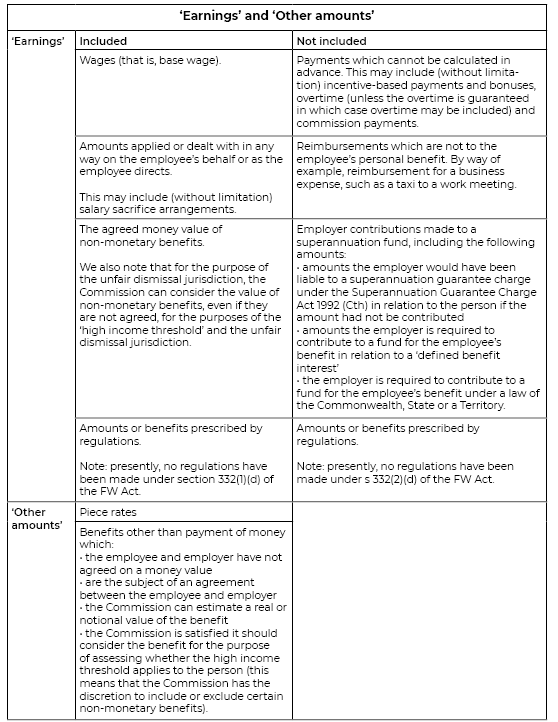

Section 332 of the FW Act provides a definition of ‘earnings’ which expressly includes and excludes certain amounts from the meaning of ‘earnings’. Those amounts are set out in the following table. The Fair Work Commission (Commission) has held that section 332 of the FW Act is a non-exhaustive list, and that ‘earnings’ should be given its ordinary meaning, subject to the matters in section 332 of the FW Act being included or excluded from that ordinary meaning. This was the approach taken by the Full Bench of the Commission in Sam Technology Engineers Pty Ltd v Bernadou [2018] FWCFB 1767, which we detail below.

In addition, the ‘other amounts’ which will be taken into account for the purpose of the unfair dismissal jurisdiction are prescribed by Reg 3.05 of the FW Regulations. These ‘other amounts’ are also summarised in the following table.

Given that earnings as defined under section 332 of the FW Act is a non-exhaustive list, there remains uncertainty surrounding the status of particular types of payments and whether and how they should be included to determine whether an employee’s ‘earnings’ exceed the high income threshold.

Recent cases, as set out below, may provide employers with some helpful guidance on certain payments and benefits.

Vehicle allowances

In the decision of the Full Bench of the Commission in Sam Technology Engineers Pty Ltd v Bernadou [2018] FWCFB 1767, clarification was provided on whether and to what amount of a vehicle allowance will be included in the calculation of an employee’s earnings for the purpose of protection from unfair dismissal.

The Commission acknowledged that a vehicle allowance will not ordinarily fall within the categories of payments which are either ‘included’ or ‘excluded’ as earnings in section 332 of the FW Act (as summarised in the table above) and, being a monetary amount, would not fall within Reg 3.05(6) of the FW Regulations as a benefit other than a payment of money.

In that decision the Full Bench held that vehicle allowances should be treated in two ways:

If a vehicle has a work and a personal purpose, the Full Bench affirmed the earlier decision of Kunbarllanjnja Community Government Council v Fewings[2] and held that the monetary value of the personal and work benefit can be calculated as follows:

Other benefits

In the recent decision of Jerome Monteiro v Valco Group Australia Ltd T/A Valco Group Australia [2019] FWC 2410 (Valco Group Case), the Commission applied the above method of calculating the personal benefit of a vehicle allowance and also considered other ‘grey areas’ of pay packages and whether they fall into an employee’s ‘earnings’ for the purpose of determining protection from unfair dismissal as follows:

Takeaway for employers

Determining an employee’s ‘earnings’, and specifically whether they exceed the ‘high income threshold’ requires a careful assessment of the employee’s benefits on a case by case basis. It is important to remember, however, that an employee whose earnings exceed the ‘high income threshold’ may still be eligible to bring an unfair dismissal claim if they are otherwise covered by, for example, a modern award or enterprise agreement.

[1] ‘Defined benefit interest’ has the meaning give to it under section 291-175 of the Income Tax Assessment Act 1997 (Cth).

[2] Print Q0675 (AIRCFB, Ross VP, Watson SDP, Bacon C, 7 May 1998)

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this newsletter is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: