07 September 2022

4 min read

#Competition & Consumer Law, #White Collar Crime & Regulatory Investigations

Published by:

The federal government has fired the starter’s gun on its competition and consumer law reform agenda, with the release of a Draft Bill that would see companies and individuals face significantly higher penalties for breaching the Competition and Consumer Act 2010 and the Australian Consumer Law.

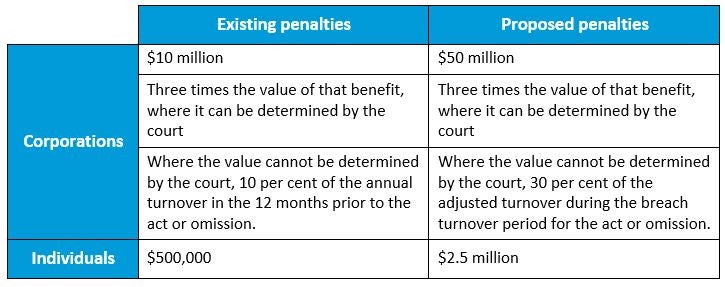

The Treasury Laws Amendment (Competition and Consumer Reforms No. 1) Bill 2022: More competition, better prices, proposes to increase the maximum pecuniary penalties for corporations to $50 million and to 30 per cent of a corporation’s annual turnover over the period the breach occurred (whichever is greater). The Bill would also see the maximum fines for individuals who engage in anti-competitive conduct and breaches of the consumer law protections increase from $500,000 to $2.5 million.

The table below sets out how the proposed new penalties compare to existing penalties.

These amendments follow a 2018 Organisation for Economic Co-operation and Development (OECD) report that found Australia’s average and maximum competition penalties in particular were substantially lower than those in comparable international jurisdictions.

Eager to act on this report, the Draft Bill’s passing is likely to be a quick win for the new government while also fulfilling an election commitment.

The release of the Draft Bill is a continuation of previous efforts to increase the penalties for breaches of Australia’s competition and consumer laws.

It has been almost 30 years since the maximum penalty for breaches of the competition provisions was increased to $10 million for corporations and $500,000 for individuals. As a result, there were concerns within government that a breach of competition law may be seen as an acceptable cost of doing business, particularly for large corporations.

The amendments proposed by the Draft Bill seek to increase the severity of Australia’s competition penalty regime substantially and said to bring the fines more in line with maximum penalties available in comparable international jurisdictions.

The most significant change (which does appear out of step with other comparable jurisdictions for competition law contraventions) is the change to the ‘turnover penalty’. This change would see not only a change in the duration of the calculation of the penalty but also the percentage of the calculation. Given competition contraventions often extend over a considerable amount of time before detection, there is a significant threat to businesses should such a penalty be imposed. Balancing this with the potential for significant penalties, it is arguable that such penalties can no long be treated as ‘the cost of doing business’.

Conversely, the penalties under the Australian Consumer Law were last increased in 2018 to align with the competition law penalties. While the penalties for competition law breaches were substantially lower than similar competition law regimes, in a global context, Australia’s consumer law penalties are among the highest in the world. The proposed updates to the consumer penalties would see this position maintained.

With this Draft Bill, the federal government hopes to further deter non-compliant conduct by ensuring the price of misconduct is high and reducing the financial benefits and incentives for businesses to engage in conduct that breaches competition and consumer laws.

If it was to pass, only time would tell whether this Draft Bill has the intended effect. Competition law proceedings are slow to progress through the courts and it could be years before the new penalties filter through and create any real deterrent.

While it doesn’t appear that the current consumer law penalties have been inadequate. In fact, the Australian Competition and Consumer Commission (ACCC) has had more success enforcing consumer law breaches and judges have been prepared to impose significant penalties (even in cases where the penalties imposed were not wholly under the current penalty regime). For example, the Australian Institute of Professional Education Pty Ltd (in liquidation) was fined $53 million in 2021 and Volkswagen was penalised $125 million in 2019 for Australian Consumer Law breaches.

The federal government still needs to clear the parliamentary hurdle in order to get this Draft Bill across the finish line.

In the meantime and given the potential consequences of this Draft Bill, companies should remain vigilant in minimising the risk of competition and consumer law breaches, and any associated ACCC investigation or enforcement action.

Companies should therefore consider the competition and consumer law policies they currently have in place and ensure they maintain adequately resourced compliance programs through appropriate training.

Understanding and maintaining key responsibilities and obligations under Australia’s competition and consumer laws will enable all corporations to compete on their merits in a fair and open market, while also ensuring consumers are treated fairly.

Our team can assist you in understanding your competition and consumer law risks, developing mitigating policies and processes, and delivering compliance training.

We can also assist you in dealing with any ACCC investigations and enforcement actions. If you have any questions, please contact us or send in your enquiry here.

Authors: Joanne Jary & Kayla Plunkett

Disclaimer

The information in this article is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: