26 October 2021

7 min read

If you are planning to rezone land in Victoria, or if there is a risk of the Victorian Government rezoning your land, you need to be mindful of the Windfall Gains Tax and State Taxation and Other Acts Further Amendment Bill 2021 (Bill), which the Victorian Government introduced into Parliament on 12 October 2021.

A rezoning of Victorian landholdings that takes effect on or after 1 July 2023 and results in an increase in value of more than $100,000 could expose you to a windfall gains tax of up to 50% of the total uplift in value.

The windfall gains tax will be a new state-based tax imposed on the increase in the value of land resulting from rezoning. It is proposed to commence from 1 July 2023 and will be administered by the Commissioner of State Revenue.

If the Bill passes, landholders will be exposed to a tax rate of up to 50 per cent on the total value uplift if the land is rezoned on or after the commencement date (1 July 2023) and results in an increase in land value of more than $100,000.

Taxable value uplift is the difference in the improved capital value of the land pre and post-rezoning. For example, if the land was valued at $200,000 based on its zoning before rezoning and at $500,000 after rezoning, the taxable value uplift would be $300,000.

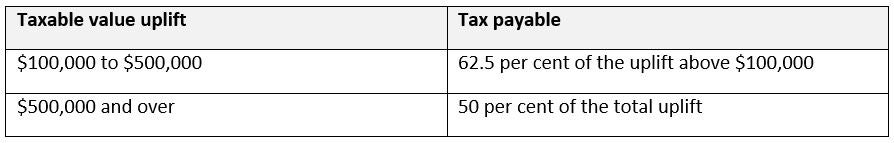

With a taxable value uplift (from rezoning) of over $100,000, the tax payable can be calculated at the following rates:

To avoid taking into account changes in value due to changes in economic conditions, the value of the land pre and post-rezoning is considered at the same date, being the date of the most recent valuation of the land.

The relevant valuation of the land is the valuation prepared in accordance with the Valuation of Land Act 1960. That valuation is prepared by the Valuer-General (or a delegate) and is the same valuation as is relied on for council rates and land tax. Therefore, the most recent valuation (in most cases) will be the valuation reflected in the most recent rates notice issued for the land.

The post-rezoning land valuation is also prepared by the Valuer-General. The proposed legislation includes the provision for that to be requested by the Commissioner as a supplementary valuation to allow windfall gains tax to be calculated. Landholders have a limited ability to object to a valuation prepared to determine the value of land post-rezoning.

Grouping and aggregation provisions apply so that the $100,000 threshold applies only once to properties owned by the same owner or group of owners rezoned under the same planning scheme amendment. The provisions group related companies and trusts with their controllers, and where a landowner is a discretionary trust the provisions permit the Commissioner to effectively determine they are related even if no individual has an entitlement to the income or capital of the trust.

The windfall gains tax becomes payable by the landholder at the time that the rezoning takes effect.

Generally, rezoning takes effect either at the time that notice of the approval of the amendment is published in the Victorian Government Gazette or at a later date specified in such a notice of approval. This can occur years after the rezoning is first proposed and consultation around the rezoning commences.

Landholders can defer payment of windfall gains tax until the earlier of the next dutiable transaction of their land (other than an excluded dutiable transaction) or 30 years from the date of the rezoning. Excluded dutiable transactions, where deferral arrangements can continue even after the dutiable transaction, include:

Whether to defer payment or not is a choice as interest does accrue on the deferred liability. Deferral can be for part or the whole of the liability.

The windfall gains tax payable also forms a first charge over the land, which is payable in priority to all other encumbrances, including mortgages entered into before a rezoning event occurs. The impact that deferral may have on securing finance secured against the land is therefore a relevant consideration in choosing whether to defer payment.

There are some exemptions and transitional provisions. These include:

The publication of the draft legislation will alleviate some fears around landholders having to immediately fund a significant tax liability over which they had little notice and little control.

Developers, in particular, could be advantaged by the ability to defer payment until the time of the next dutiable transaction, enabling them to fund payment of that liability from the project that gave rise to it.

Even so, the feasibility of existing projects should be reassessed with consideration to the announced measures as the combination of the windfall gains tax, capital gains tax and other state-based taxes (especially for foreign owners) can result in tax on such arrangements nearing 100 per cent of the increase in value when combined.

Where a review of existing arrangements is undertaken, it is important to note that the measures announced are silent as to how the transitional measures apply to existing contractual agreements that are varied after 15 May 2021. Therefore, any such variation may risk the arrangement ceasing to qualify for transitional measures.

For some groups, such as farmers and family groups with significant landholdings, the measures could still cause significant pain where those landholdings would usually be passed down through generations. Ultimately, the maximum timeframe for which payment can be deferred is 30 years.

Considering the grouping and aggregation measures, it would be appropriate to review ownership structures through which landholdings are held. Discretionary trusts, in particular, are an ownership structure not only more likely to be grouped under the windfall gains tax provisions than for various other taxes, but also to be grouped widely given the discretion the Commissioner has to group them with beneficiaries even if those beneficiaries have no entitlement to income or capital.

It would also be appropriate to consider funding structures and options. The fact that windfall gains tax could be a first charge over land ranking in priority to existing mortgages may impact the amounts that secured lenders are willing to lend against land and/or lead to them requiring additional forms of security such as security against plant and equipment.

For rezonings already contemplated or underway and where there is an opportunity to do so, it will be in the landholders’ interests to co-operate and provide information as quickly as possible to facilitate the rezoning taking effect before 1 July 2023. Ultimately, timing will be out of the landholder’s control.

If you have any questions regarding this article or how the windfall gains tax may affect you, please speak to us or contact us here.

Author: Megan Bishop

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.