22 February 2023

8 min read

#Corporate Restructuring and Insolvency, #Dispute Resolution & Litigation

Published by:

The High Court’s recent decision in Bryant & Ors v. Badenoch Integrated Logging Pty Ltd [2023] HCA 2 (Gunns case) has important implications for liquidators and companies, as it has removed liquidators’ unfair advantage in unfair preference cases.

The High Court found that the unfair preference provisions in the Corporations Act 2001 (Cth) (Corporations Act) do not incorporate the “peak indebtedness rule”. This means that a company’s liquidator can no longer decide when the “single transaction” starts for the purposes of determining whether there has been an unfair preference by a company to a creditor over the course of their continuing business relationship.

As a result, the liquidator can no longer skew the circumstances to maximise the potential for there to be an unfair preference and the amount of any unfair preference. Instead, the facts of the case will dictate these matters.

Until the Gunns decision, a series of cases in Australia applied what’s known as the “peak indebtedness rule”. This rule allows the liquidator to choose when the “single transaction” starts (within the prescribed period according to the Corporations Act) for the purposes of determining whether there has been an unfair preference by a company to its creditor over the course of their continuing business relationship.

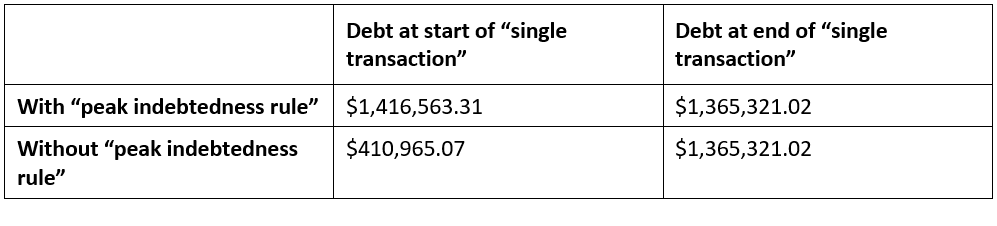

The liquidator can therefore maximise the potential for the claw-back of money and assets from a creditor, as they are able to select the point where the company’s debt to its creditor is at its peak to be the start date of the “single transaction”. To illustrate – the application of the “peak indebtedness rule” in the Gunns case (see case details here) would have provided strong evidence that an unfair preference had occurred. If the rule was allowed, the debt from the company to its creditor would have declined over the “single transaction” to the end of the parties’ “continuing business relationship”. Comparatively, if the rule was not allowed, the debt would have significantly increased:

The liquidators contended that the difference between the peak indebtedness and the end indebtedness represented the amount of the unfair preference paid by the company to its creditor.

The voidable transactions provisions are contained in part 5.7B of the Corporations Act, and enable a company’s liquidator to apply to the court to make orders regarding transactions that are ‘voidable’. These orders may include an order directing a person to pay the company an amount equal to some or all of the money the company has paid under the transaction.

A transaction is ‘voidable’ if it is:

The question in the Gunns case was whether a series of transactions between a debtor and a creditor constituted an ‘unfair preference’ according to section 588FA of the Corporations Act in the context of the parties’ continuing business relationship.

Relevantly, where transactions between the parties are considered to be part of a continuing business relationship, section 588FA(3) is enlivened where:

then:

The effect of section 588FA(3) is that transactions between the company and its creditor are therefore looked at as a “single transaction”, and accordingly may be netted off against each other to determine any unfair preference.

The Gunns case was an appeal from the Federal court, which involved an application by the liquidators of Gunns Limited (in liquidation) (Gunns), to have a series of transactions between Badenoch Integrated Logging Pty Ptd (Badenoch) and Gunns set aside, and repaid, as voidable transactions.

Badenoch was a creditor of and former supplier of timber harvesting and hauling services to Gunns. Their business relationship commenced in 2003 when they entered into an agreement for Badenoch to supply Gunns with timber.

From 2010, Gunns suffered significant declines in revenue, resulting in Gunns appointing liquidators as joint and several administrators on 25 September 2012.

Badenoch continued to provide services to Gunns despite their financial troubles. However, they ultimately agreed to terminate their agreement in August 2012, on the basis that Badenoch would continue to supply some services for a further short period to enable “another contractor [to get] up to speed”.

The High Court rejected the use of the “peak indebtedness rule”, finding that the so-called rule is inconsistent with the intent and language of section 588FA(3) of the Corporations Act.

Instead, Jagot J (with whom the other judges agreed) ruled that the first transaction that can form part of the continuing business relationship referred to in section 588FA(3) of the Corporations Act is the later of either:

Running account principle

In coming to this conclusion, the High Court found that section 588FA(3) of the Corporations Act is designed to give effect to the “running account principle” but not the “peak indebtedness rule”. Section 588FA(3) of the Corporations Act does this by questioning whether there has been an unfair preference to be determined by reference to the “ultimate effect” of the transactions during the relevant period in the running account as a whole.

The “running account principle” also recognises that a creditor may continue to supply a company on a running account, even in circumstances of suspected or potential insolvency, but which enables the company to continue to trade to the likely benefit of all creditors. The Court considered that this purpose:

Policy choice

Following the above analysis, the High Court also identified that, although the “peak indebtedness rule” is not irreconcilable with the “running account principle”, it is still not preferable on a policy basis.

The policy choice available between the two starting points is as follows:

The High Court concluded that the second choice was preferred on a policy basis due to the focus of the insolvency provisions in the Corporations Act upon the first transaction in the relationship capable of being a voidable transaction.

Having determined the date of the first transaction in the relevant relationship, Jagot J turned to consider the proper approach for determining whether a “transaction is, for commercial purposes, an integral part of a continuing business relationship between a company and a creditor of the company” pursuant to section 588FA(3)(a).

Justice Jagot considered that, to answer this question, it is necessary to consider the whole of the evidence of the “actual business” relationship between the parties, evaluated in its commercial context.

In the Gunns case, there were two relevant sets of payments – the first set was found by the court to have been made as part of a continuing business relationship, and the second was not.

Relevantly, although both sets of payments were made following a demand by Badenoch that Gunns pay outstanding debts, the key difference between the two sets of payments was that:

Justice Jagot concluded her decision by finding that the ‘continuing business relationship’ continued until the date of the last invoice issued by Badenoch to Gunns, for supply made when they were still contemplating supply being continued under the agreement if the non-payment was rectified.

As a result, the High Court found that, because the net indebtedness of Gunns to Badenoch increased during the period of the “single transaction”, being from the date of the insolvency to the end of the business relationship, there could be no unfair preference. The appeal was therefore dismissed.

Our team can assist you in responding to claims by liquidators pursuant to the Corporations Act, including in relation to the voidable transaction provisions. If you have any questions, please get in touch with us using the contact details below.

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: