The ATO is a well-resourced and highly effective tax regulator. Its sophisticated audit and assurance programs, coupled with significant powers mean that all types of taxpayers can be exposed to the risk of audits, reviews and disputes.

Some broad considerations for taxpayers in managing their engagements with the ATO and overview of the ATO processes are outlined in this section of the Tax Hub.

Effective tax governance and documented frameworks can assist in obtaining ‘Justified Trust’, which will impact the manner in which the ATO engages with a taxpayer and the level of perceived risk.

Constructive engagement with the ATO is critical to ensuring positive outcomes of reviews and disputes when they do occur. Even where differences arise between your position of how the law should work and the ATO’s view, it is preferable to maintain a cordial working relationship. To minimise disruptions, taxpayers should ensure they maintain contemporaneous evidence of commercially driven positions and tax treatment of such transactions.

We generally advise taxpayers to engage the ATO as early as possible to avoid potential controversies. The ATO has various procedures in place including private and class rulings which provide a level of certainty for taxpayers as to how particular circumstances will be viewed by the ATO ‘before the fact’.

Being aware of the various stages of the ATO’s processes will allow taxpayers to quantify their legal and commercial risks before making decisions regarding how they wish to engage with the Commissioner.

The ATO has issued guidance on conduct that attracts the Commissioner’s attention, and how it will select a particular taxpayer for an audit. Generally, taxpayers are selected for an audit based on conduct which flags its attention including:

Read our article 'Court limits ability for taxpayers to challenge the validity of formal ATO notices' here.

The ATO’s investigatory processes range from relatively simple information reviews to far-reaching audits. Broadly speaking, the audit and dispute life cycle can be divided into four stages:

Often, before a formal audit, the ATO will conduct an internal risk review with an aim of identifying any tax issues or non-compliance which requires further investigation. Pre-lodgement compliance reviews and streamlined assurance reviews (through the ATO’s justified trust program) often satisfy this. The ATO may in some cases contact the taxpayer and request an interview or further information.

Once risks are internally assessed by the ATO, a decision will be made to either discontinue the review or escalate it to audit.

If the ATO identifies issues at the risk review stage, they may proceed to an audit of the taxpayer’s affairs. This may include use of both informal requests for information or the use of the Commissioner’s formal information gathering powers.

The core purpose of an audit is information gathering to allow the tax office to reach a position in respect of their taxpayer’s assessment. The ATO will review information it has collected and reach a position (for large businesses the ATO will issue a position paper outlining its approach) which follows from the audit process.

The taxpayer is entitled to seek an independent review prior to the ATO closing the audit, conducted by a senior ATO officer who has not previously been involved in the audit process. If the result of the audit is unfavourable, the Commissioner will issue a notice of amended assessment, specifying shortfall amounts payable by the taxpayer. Amended assessments may attract significant penalties and interest.

Engaging independent legal advice can assist in guiding the taxpayer’s response to audits and reviews, and such advice is generally subject to legal professional privilege.

Taxpayers who dispute a decision or amended assessment can lodge a formal objection with the ATO outlining the reasons for the disagreement.

An objection must be lodged in the approved form within the period set out in the tax laws – the time limits depend on the type of decision the objection relates to. The ATO publish time limits to object to a decision, and where out of time, the Commissioner can exercise discretion to allow late objections to be made in certain circumstances considering:

Grounds of objection and reasoning must be carefully framed to ensure that additional issues that the taxpayer may wish to raise in future litigation are also included. The Commissioner will respond to the objection by issuing an objection decision. If the objection decision is unsatisfactory, the taxpayer may be able to appeal that decision, but must lodge the appeal within 60 days of the decision being issued.

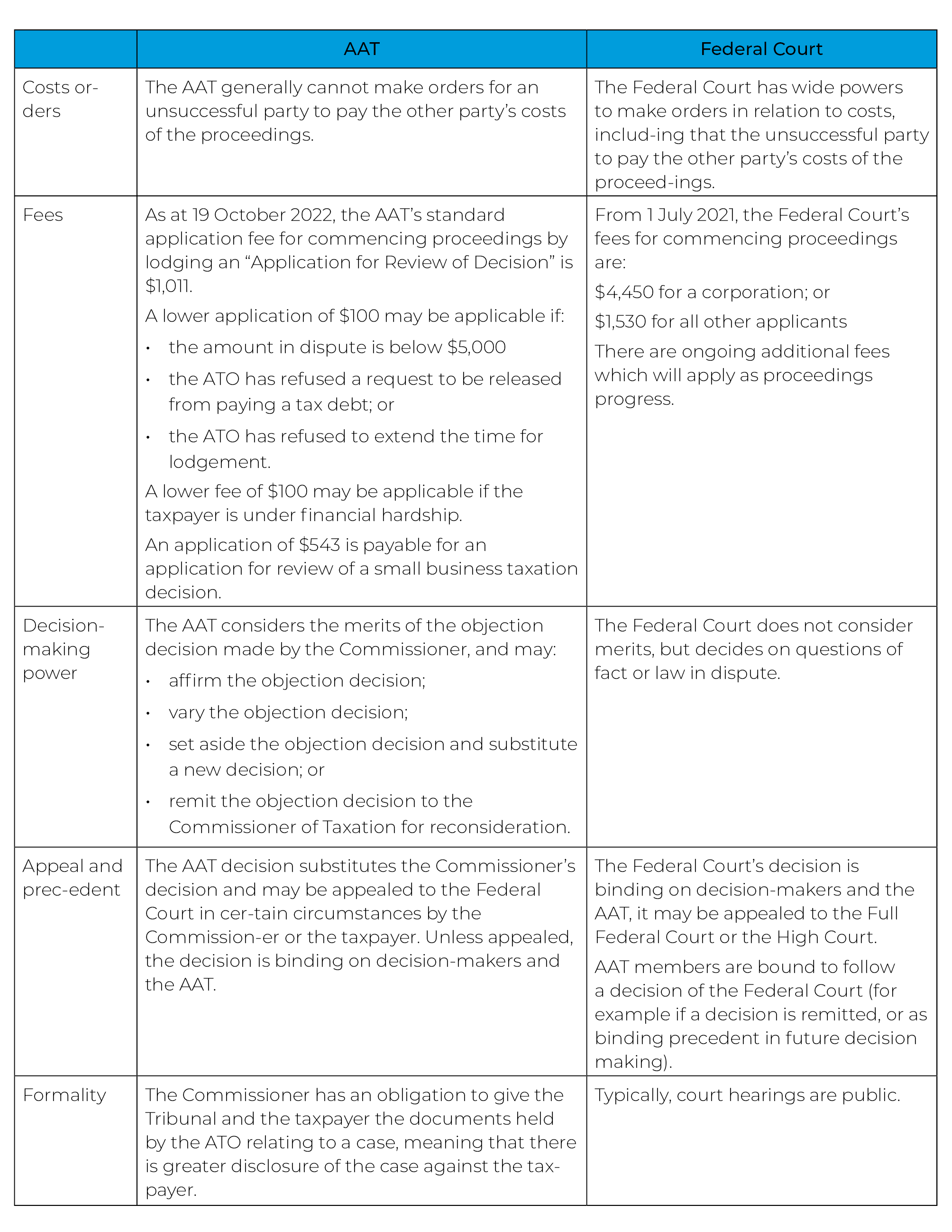

Taxpayers may be able to appeal objection decisions in the AAT or the Federal Court, depending on the issues in dispute. Some strategic factors which the taxpayer might consider in relation to which forum to choose are outlined below:

Our team has extensive experience in assisting clients with reviews, audits and litigation at the Administrative tribunal, Supreme Court, Federal Court and High Court of Australia.

Our specialist tax dispute team combines strong tax technical skills and litigation expertise to assist in resolving tax disputes expediently and cost effectively. We understand the importance of managing risk strategically and can help to minimise disruptions through the review, audit and dispute process.

Assistance we can provide includes: