The ATO has adopted the ‘Justified Trust’ concept from the Organisation for Economic Cooperation and Development (OECD) and have applied the notion to its engagements with large organisations and private groups.

Justified Trust is focused on developing confidence between the ATO (as a representative of the wider community) and the taxpayer by integrating the management of tax risks into corporate governance considerations. Good tax governance assists the ATO in ‘trusting’ that the correct amount of tax has been paid and facilitates a streamlined approach to compliance.

The ATO’s Tax Avoidance Taskforce has applied the Justified Trust methodology to conduct reviews on various taxpayers with a focus on the ‘top 100’ and ‘top 1000’ public groups and ‘top 500’, ‘top 5,000’ and ‘medium and emerging enterprise’ private groups. The reviews focus on whether taxpayers are paying the correct amount of tax and have appropriate tax governance processes.

Taxpayers, in particular those falling into the ATO’s focus groups should look to implement a robust tax governance framework which is well documented in the event of a review.

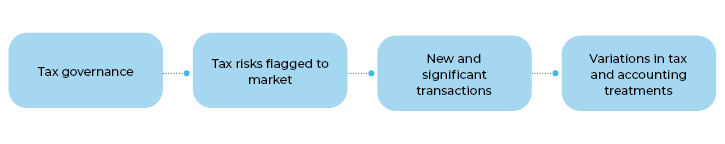

In its reviews, the ATO will consider four core areas considered important to obtaining Justified Trust.

The ATO will seek to understand the taxpayers’ tax governance framework through:

The ATO will assess whether risks it has communicated to the market (such as through Taxpayer alerts, Practical Compliance Guidelines and Public Rulings) are present. If such risks are identified, the ATO will engage further to:

The ATO seeks to understand current business activities and review new or significant transactions from a tax perspective.

The ATO will analyse variances between the tax and accounting treatments adopted by taxpayers and whether such practices are consistent with business activity and industry practice.

There are three categories of taxpayers who the ATO currently focus on.

The Top 500 include private groups with:

Groups within the Top 500 can expect tailored engagements with the ATO using the ‘Justified Trust’ methodology. Based on these engagements, Top 500 groups are classified as follows:

Top 500 groups considered to have attained Justified Trust will be classified as ‘partners’. The ATO has confidence that these groups are paying the correct amount of tax, and would reduce the intensity of ATO engagements – only verifying significant new transactions and discussing material changes to these groups during the three year ‘monitoring and maintenance phase’.

Top 500 groups in the ‘encouraging’ category are able to demonstrate a basic level of compliance, but some non-compliances or other issues (including the sufficiency of tax governance) have been identified through the ATO’s review. The ATO will engage with these groups to encourage them to address concerns and seek greater transparency.

This category includes groups who are considered to lack transparency and adopt aggressive approaches to managing their tax affairs. These groups may experience intensive interaction with the ATO, including the use of formal information gathering powers and audits.

The Next 5,000 includes individuals and groups linked to Australian tax residents not already covered by the Top 500 program, who, together with their associates, control wealth of more than $50 million.

Next 5,000 groups can expect to be subject to a streamlined assurance review covering the two most recent income years. The ATO applies the Justified Trust methodology to obtain assurance that the group has reported and paid the correct amount of tax.

Next 5,000 groups are likely less sophisticated than Top 500 groups and may not have an understanding of the ATO’s expectations in regards to tax governance. Next 5,000 Groups should focus on reviewing existing protocols, and if necessary develop and implement new tax governance frameworks.

Medium and emerging private groups are:

The ATO estimates that medium and emerging private groups represent about 97% of the total private group population, and it will focus on engaging with larger or high risk private groups within this category.

Tax governance is one of the core review areas within the Justified Trust methodology. In the review process, the ATO will look to confirm the existence and application of a groups tax governance framework, which people at various levels and functions within the group should be aware of and understand.

Whilst the ATO assesses the appropriateness of a group’s tax governance framework in light of factors unique to it (such as structure, industry and history), there is an expectation that all groups incorporate basic principles of effective tax governance.

These are:

The ATO will generally request the following as part of a justified trust review:

All taxpayers should prepare for reviews by performing self-checks to identify any potential inconsistencies, ensure justifications for all positions taken and consider corrective action where appropriate.

Our team of experienced tax practitioners are well positioned to help you prepare for justified trust reviews, as well as any relevant engagements with the ATO.

Services we offer include: