15 November 2022

5 min read

Changes to Australia’s competition and consumer law mean businesses will now face new and increased penalties for breaches of the Australian Consumer Law (ACL) and the unfair contracts terms law. The Treasury Laws Amendment (More Competition, Better Prices) Bill 2022 (Cth) (Bill) received Royal Assent last week, which triggered a suite of changes to the Competition & Consumer Act 2010 (Cth) (CCA) and the ACL.

Key among those changes are:

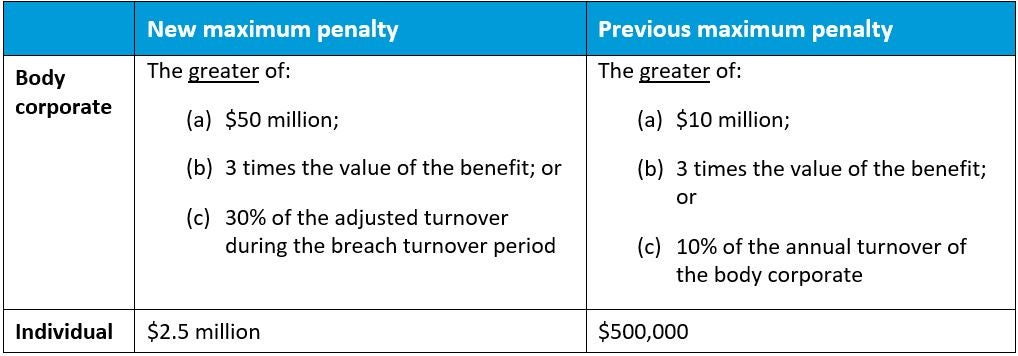

The Bill amends the maximum penalties under the CCA and ACL for a range of conduct, including breaches of civil penalty provisions in those parts of the legislation governing restrictive trade practices and consumer law. This means the new penalties will apply to instances of unconscionable conduct, false or misleading representations, unfair contract terms (from November 2023), referral selling, breaches relating to safety standards, anti-competitive agreements, exclusive dealing, and more.

The new maximum penalty for these offences is:

Particular attention should be given to the new definitions of ‘adjusted turnover’ and ‘breach turnover period’ in calculating damage. In summary, the 30 per cent will be calculated based on the value of all supplies made not just by the offending body corporate but also its related bodies corporate (in connection with Australia) during the period of the breach (a minimum of 12 months).[1] Penalties under this limb, therefore, have the potential to be substantial.

The increase in available penalties is consistent with recent trends towards higher fines being sought and imposed by the Australian Competition & Consumer Commission and Courts, respectively.

Unfair contract laws are designed to deter the use of unfair contract terms when engaging with consumers and small business under “standard terms” arrangements. Currently, these laws allow a court to declare unfair terms contained in such standard form contracts to be void and unenforceable.

The Bill amends both the CCA (including the ACL) and the Australian Securities and Investments Commission Act 2001 (ASIC Act) (which is concerned with financial products or services contracts). This article considers the ACL changes only.

The key areas of reform are:

Each unfair term in a contract will constitute a separate contravention.

This will replace the existing provisions which require one party to the contract to have fewer than 20 employees and the contract to have an upfront price payable of less than $300,000 (or $1,000,000, if more than 12 months).

(Determination of standard form contracts) When determining whether a contract is a standard form contract, the court will now be required to consider whether one of the parties has made another contract in the same or substantially similar terms and, if so, the number of contracts that party has made. Similarly, the Bill inserts an explicit acknowledgement in the law, which recognises that a contract may be deemed to be a standard form contract despite there being:

In addition to the new penalties, the Bill introduces new remedies. In particular, a court will be permitted to make an order preventing a party from including a term in any relevant contract in the future that is the same, or substantially similar, in effect to a term declared unfair.

These changes will commence from November 2023 and apply to contracts made or renewed, and contractual terms varied on, or after, that date.

Industry should be aware of the increased maximum penalties and expanded scope for breaches of these competition and consumer law provisions, and take pre-emptive action to minimise their risk. Recommended steps include:

Our team can assist you in understanding your competition and consumer law risks, developing new terms or mitigating policies and processes, and delivering compliance training.

We can also assist you in dealing with any ACCC investigations and enforcement actions. If you have any questions, please contact us below or send in your enquiry here.

1 Certain supplies will be excluded from this assessment. See: Explanatory Memorandum, Treasury Laws Amendment (More Competition, Better Prices) Bill 2022 (Cth).

2 Explanatory Memorandum, Treasury Laws Amendment (More Competition, Better Prices) Bill 2022 (Cth).

Disclaimer

The information in this article is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.