Regulatory Updates

ASIC cyber security statement (1 March 2022)

In light of the Ukraine conflict, ASIC advised trustees to follow the Australian Cyber Security Centre’s warning to adopt an enhanced cyber security posture, including:

- reviewing and enhancing detection, mitigation, and response measures

- logging and detecting systems are fully updated and functioning and apply additional monitoring of networks where required

- assess preparedness to respond to any cyber security incidents and review incident responses and business continuity plans.

APRA quarterly superannuation statistics (1 March 2022)

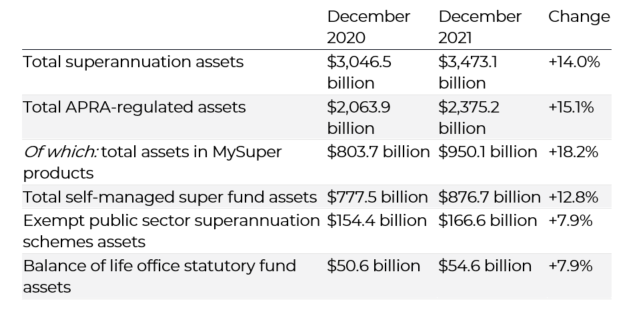

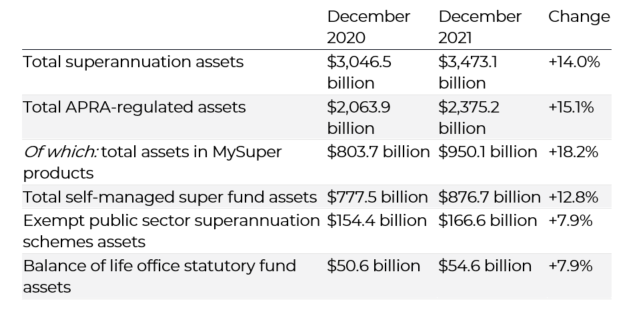

APRA released its ‘Quarterly Superannuation Performance Report’ (Performance Report) and ‘Quarterly MySuper Statistics Report’ (MySuper Report) for the December 2021 quarter.

The MySuper Report provides data relating to superannuation products’ profiles, asset allocation targets, investment performance, and fees.

The Performance Report contains sector performance statistics, including the growth in funds under management, as follows:

APRA letter: climate risk self-assessment survey (2 March 2022)

APRA confirmed that it will shortly commence a voluntary survey of trustees focusing on their approaches to considering the financial risks of climate change and the expectations set out in APRA’s Prudential Practice Guide CPG 229 Climate Change Financial Risks.

The survey is yet to be released.

Treasury and APRA statements on superannuation fund holdings of Russian assets (3 & 7 March 2022)

Treasury confirmed its strong expectations that trustees will take steps to divest any holdings in Russian assets. In support, APRA has stated it will not be taking any action against trustees who seek to divest Russian assets but provided that trustees have considered such divestments in accordance with their duties.

Our comment

The Federal Government’s statement is interesting – it echoes one of the initially intended provisions of the Your Future, Your Super Bill that would have enabled a Federal Government to veto super fund investments. Problematic, also, is whether divesting (or how it is undertaken) is in the best financial interests of members. This will clearly be an issue for those seeking to sell off assets to a market that may be flush with other sellers.

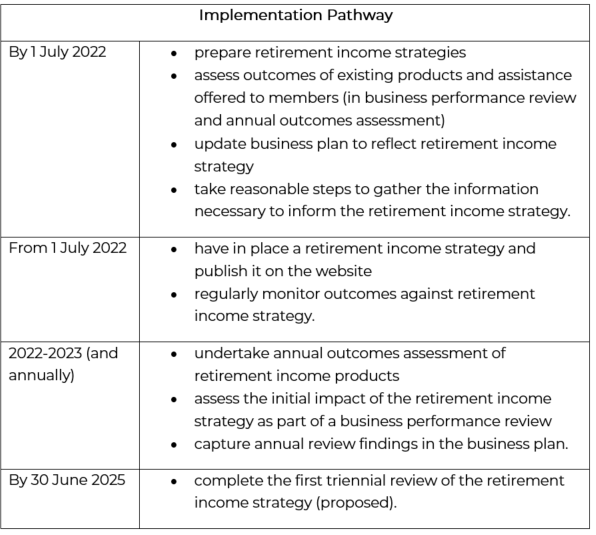

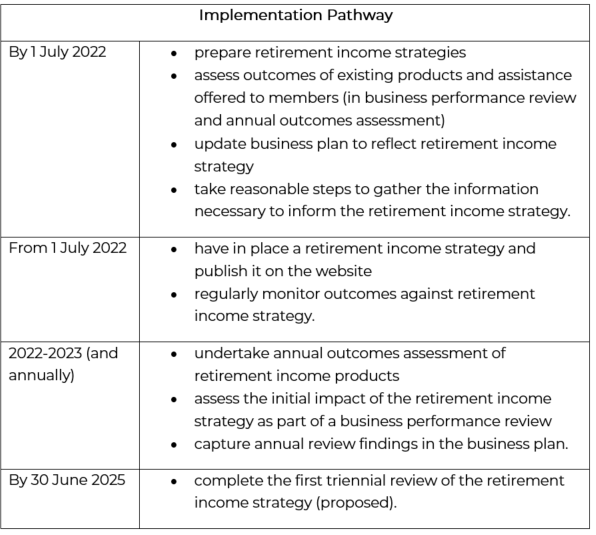

APRA/ASIC Letter: Implementation of the retirement income covenant (7 March 2022)

APRA and ASIC released a joint statement outlining expectations for trustees regarding the retirement income covenant (RIC), which takes effect from 1 July 2022. The joint statement provides the following implementation pathway that trustees should consider when meeting the RIC:

ASIC and APRA also outline the following key considerations when executing the implementation strategy:

- oversight and strategy implementation

- strong product governance and distribution practices

- robust analysis of member cohorts / sub-classes

- quality of data used

- types of assistance for members.

Treasury Quality of Advice Review (11 March 2022)

Treasury released the terms of reference for its quality of advice review, which include examining:

- the legislative framework for financial advice, specifically:

- key concepts such as ‘financial product advice’, ‘general advice’, ‘personal advice’, how they are used and how consumers interpret them

- whether the safe harbour provision for the best interests duty should be repealed

- financial advice documentation and disclosure requirements, including statements of advice

- fee disclosure and consent requirements, including reforms to introduce annual renewal of ongoing fee arrangements

- the life insurance remuneration reforms and the impact of the reforms on the levels of insurance coverage

- the remaining exemptions to the ban on conflicted remuneration, including in life and general insurance.

- whether consent arrangements for sophisticated investors and wholesale clients are working effectively for financial advice

- the actions that are undertaken by ASIC, including regulatory guidance and class orders

- the role of financial services entities and professional associations.

When examining the above, regard should be given to:

- structural changes and professionalisation of the sector

- best practice developments internationally

- the level of demand for advice and the needs and preferences of consumers

- innovation and the development of technological solutions, including the use of regulatory technology and digital advice

- opportunities to reduce compliance costs in the industry while maintaining adequate consumer safeguards

- other key regulatory developments, including the Consumer Data Right, the Retirement Income Covenant, and the Design and Distribution Obligations that apply directly to financial advice

- the interim findings of the Australian Law Reform Commission’s Review of the Legislative Framework for Corporations and Financial Services Regulation are considered.

The report will be provided to the Federal Government by 16 December 2022.

Financial Regulator Assessment Authority member appointed (14 March 2022)

The Government has appointed Ms Fiona Crosbie to the Financial Regulator Assessment Authority (FRAA) for 21 March 2022 to 14 September 2026.

The FRAA is an independent statutory body tasked with assessing and reporting on the effectiveness and capabilities of ASIC and APRA.

APRA publishes additional FAQs on the Superannuation Data Transformation Phase 1 reporting standards (17 March 2022)

APRA has updated one FAQ and published two additional FAQs as follows:

- updated FAQ 1.0: What data is required for the historical data collection and what are the due dates for submission of data under the SDT reporting standards?

- new FAQ: 251.2e: How should RSE licensees report cases where the assessment of insurance claim did not occur due to the insurance claim being withdrawn or closed?

- new FAQ: 550.0p: What does APRA expect RSE licensees to report for the strategic sector related fields under SRF 550.0 table 2?

APRA statement on sustainability (28 March 2022)

In a speech to the Investment Magazine Chair Forum, APRA Member, Margret Cole, discussed sustainability challenges for the superannuation sector, including:

- APRA is preparing to soon release hard evidence proving that the lack of scale of funds not only hinders performance now but undermines the ability of funds to deliver sound member outcomes in the future

- administration fees and operating expenses of the funds with net assets greater than $50 billion (Large Funds) are significantly less than that funds with net assets under $10 billion (Small Funds) – 0.33% of net assets compared to 0.57%

- half of the Small Funds face sustainability challenges with declining net cash flows and member accounts

- Small Funds face the most adverse trends in net cash flows. Even medium-sized funds (in the $10 billion to $50 billion range) generally displayed negative trends, with only six funds having positive net cash flow ratios

- a sub-set of Small Funds consistently bucked the sustainability trend and were managing to grow. These Small Funds generally provided specialised offerings, such as environmental, social, and governance (ESG) focused products

- APRA cannot directly force even the poorest performing, least sustainable fund to merge, but APRA will use the extent of its powers to push certain funds towards this end.

2022-23 Federal Budget (29 March 2021)

The Treasurer announced the following proposed changes that impact superannuation:

- extending the 50% reduction of the superannuation minimum drawdown requirements that a retiree has to draw from their superannuation in order to qualify for tax concessions

- from 1 July 2022, the maximum amount of voluntary contributions that can be released under the First Home Super Saver Scheme will be increased from $30,000 to $50,000.

Legislative Updates

Treasury Laws Amendment (Enhancing Superannuation Outcomes) Regulations 2022 (Cth) (3 March 2022)

The Regulations amend the Income Tax Assessment (1997 Act) Regulations 2021 (Cth) to

support the reduced eligibility age for downsizer contributions into superannuation from 65 to 60 years, and to repeal the work test for non-concessional and salary sacrificed contributions for individuals aged 67 to 74 (inclusive).

Taxation Administration – Payment Summary Deferral: Employment Termination and Departing Australia Superannuation Payments Deferral 2022 (24 March 2022)

This Instrument defers the due date for providing the ATO Commissioner with copies of payment summaries regarding employment termination payments and Departing Australia superannuation payments to 14 August after the end of the relevant financial year.

ASIC Corporations (Repeal and Transitional—Relief for Providers of Retirement Estimates) Instrument 2022/204 (28 March 2022)

The Instrument repeals ASIC Class Order [CO 11/1227] Relief for providers of retirement estimates (Class Order) while providing transitional relief to extend the Class Order’s effect until 31 December 2022.

The Class Order provides trustees conditional relief from various AFSL requirements in the Corporations Act when preparing retirement estimates for fund members.

ASIC Corporations (Internal Dispute Resolution Data Reporting) Instrument 2022/205 (30 March 2022)

The Instrument gives effect to the internal dispute resolution data reporting framework established by the Treasury Laws Amendment (Putting Consumers First—Establishment of the Australian Financial Complaints Authority) Act 2018 (Cth). The Instrument specifies the information that financial services licensees must give ASIC, which is outlined in the ‘IDR reporting Handbook’, relating to their internal dispute resolution procedures and the operation of those procedures.

For the first reporting period, the trustees of the following funds will be required to submit the relevant information to ASIC:

- Cbus

- UniSuper

- AustralianSuper

- REST.

Cases and other recent developments

Financial services company charged with anti-hawking offences following alleged superannuation sales cold calls (21 March 2021)

ASIC alleges a financial services company made unsolicited calls to 11 consumers, encouraging them to roll over their superannuation into different superannuation products, between August 2019 and June 2020.

The charges are brought under the pre-October 2021 anti-hawking provisions.

The hearing is listed for 16 May 2022.

Authors: Luke Hooper & Michael O’Connor

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Share this