In the globalised world in which we live, technological revolutions (such as the ability to move funds electronically) coupled with the increased ability of people to travel, mobility of capital and labour is at an all-time high.

The global tax system has responded to globalisation by concepts designed to minimise leakages in countries' tax bases such as residency and transfer pricing, and Australia has tax treaties with various countries. Whilst the fundamental ground of dispute for tax controversies is ‘how the money should be taxed’, a critical question is often ‘where should the money be taxed?’

If you are considered an Australian tax resident, you are required to pay tax on your worldwide income and capital gains from all sources at the relevant Australian tax rates. Non-residents are generally only taxed on income earned and sourced directly or indirectly in Australia.

Disputes regarding residency have serious repercussions on:

In Australia, such errors can lead to significant penalties and interest charges being applied. However, determining residency is not always simple.

Reforms to individual tax residency rules and corporate tax residency rules are being proposed.

An individual will typically be considered an Australian resident if they satisfy at least one of following criteria:

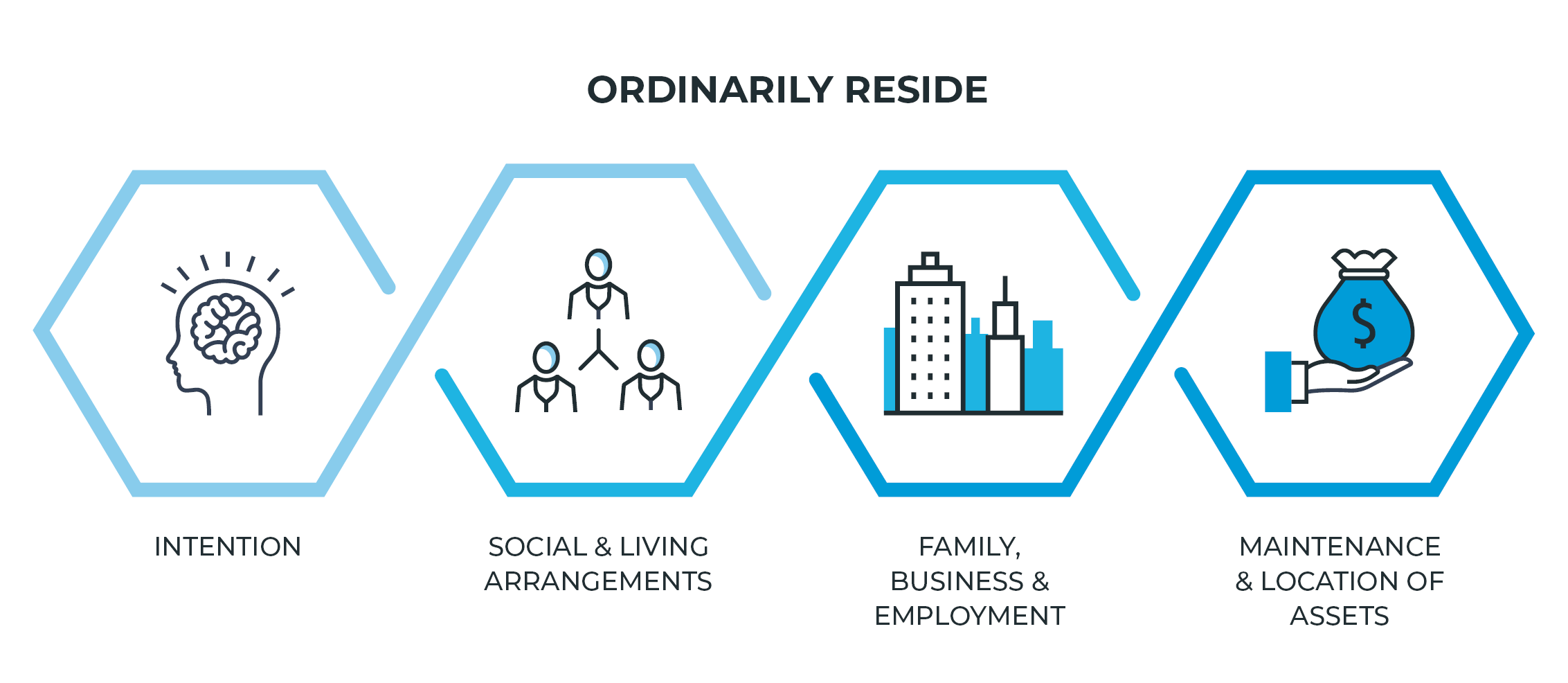

While the term ‘reside’ is not defined in the Australian tax legislation, the Commissioner considers a number of factors in determining whether an individual ‘ordinarily resides’ in Australia:

The ATO does not consider any individual factor to be decisive, and whether a person ordinarily resides in Australia is a question of fact and degree. The importance of each factor will vary with individual circumstances.

A person is an Australian tax resident if they have domicile is in Australia, unless the Commissioner is satisfied that the person's permanent place of abode is outside Australia. Domicile is usually determined by place of birth, meaning that for those born in Australia the application of the test usually turns on the permanent place of abode requirement. Even though individuals may have no fixed permanent place of abode, a permanent place of abode is guided by the concept of ‘home’.

Relevant factors in understanding permanent place of abode include:

If a person is present in Australia for more than 183 days in an income year (continuously or intermittently), they could be considered to have a ‘constructive residence’ in Australia. There are exceptions where individuals present for more than 183 days can be treated as non-resident if the Commissioner is satisfied of various matters.

Australian government employees (and their spouses and children under 16) who are contributing members of the Public Sector Superannuation Scheme or the Commonwealth Superannuation Scheme are Australian tax residents.

A corporation will be a tax resident of Australia if:

The location of the ‘central management and control’ of a company is a question of fact. In Australia, the analysis involves a determination of where (and by whom) the real decisions of the company are made, irrespective of where it is incorporated. The ATO has set out four considerations in determining whether a company meets the central management and control test:

Typically, a company’s directors exercise its central management and control at the location at which they make decisions. But where key company personnel are located in multiple jurisdictions, further factors such as location of board meetings and where dividends are paid might be considered. The nature of the entity and whether it is directors or some other person advising or working within the business that makes the key decisions in practice also needs to be considered.

If more than 50 per cent of the shareholders of a company are Australian tax residents, the company is generally also an Australian resident.

Australia has bilateral ‘tax treaties’ with over 40 jurisdictions, a list of which is maintained by the Federal Treasury.

Tax treaties codify various jurisdictions’ commitments to co-operate with each other in enforcing their tax rules, and offer clarity on how the tax rules of each nation will interact with one another. This creates certainty for mobile taxpayers who engage in international transactions by:

Additionally, tax treaties assist countries to prevent tax avoidance and evasion (including through providing clarity of the applicable transfer pricing rules) by ensuring co-operation between jurisdictions.

Your residency status (which can be impacted by a tax treaty) will determine where you pay tax and the amount of tax payable. Independent advice should be sought to ensure clarity and prevent the application of penalties.

We can assist you to obtain peace of mind and certainty around your residency status.

Our tax team acts for individuals and multinationals and are well equipped to assist with mobility issues through providing technical advice and managing engagements with the ATO.

We can assist with:

Working with the wider Holding Redlich practice we can also provide support in obtaining visas and other approvals required for travel.