Employment taxes exist within both state and federal jurisdictions. Whilst certainty of treatment is important to taxpayers, various complex issues arise. Each tax act extends the definition beyond common law employees in different ways and in ways that are also different to those that apply under the Fair Work Act and Workers Compensation legislation. It is important to be aware of those differences when engaging workers.

Some key employment taxes and issues are outlined on this page.

It is important to correctly classify workers for tax purposes – determining whether there are obligations to make superannuation contributions, withhold under the PAYG system, account for Fringe Benefits Tax (FBT) or pay payroll tax and how tax compliance reporting is to be completed. These obligations differ not just between employees and independent contractors – but for some taxes also between different categories of independent contractors.

See our State Taxes guide here.

Employers (and in some contractual relationships, principals) are generally required to withhold tax in order to ensure payees can meet their end of year tax liabilities. This is done by collecting pay as you go (PAYG) withholding amounts from payments made to employees, directors, some contractors and businesses that don’t provide an ABN. The money withheld is remitted to the ATO on the workers behalf.

The purpose for PAYG withholding is to avoid workers having to pay a large lump sum when the ATO confirms the amount of tax payable for the income year. This is because the money has already been deducted from the worker’s pay and sent to the ATO throughout the year. The administrative costs associated with collecting taxes is reduced through the PAYG withholding system.

If a business violates PAYG requirements, the company and its directors may face a penalty up to the amount which should have been withheld or paid - more information on penalties is provided here.

The distinction between whether a worker is an employee or contractor will often determine whether there is a requirement to withhold:

The ATO has a decision tool to help employers determine whether a worker is an employee or independent contractor for tax purposes. The tool can be accessed here.

The amount of money withheld under PAYG will often differ on the amount actually owed. If the ATO withholds too much money under the PAYG system, they will provide the worker with a tax refund. Alternatively, if they do not withhold enough money, the taxpayer will be required to pay an additional tax bill.

PAYG withholding may also account for other debts such as:

You are obliged to register for PAYG withholding if you:

You do not need to pay PAYG withholding for employees under the age of 18 if you pay them less than:

You must be registered for PAYG before you deduct amounts from a worker’s payment.

A fringe benefit is a benefit an employee receives from their employer, in addition to wage or salary or in return for foregoing some salary under a salary sacrifice arrangement. The benefit can be provided to an employee or their associates (generally the employee’s spouse and/or children). The tax also extends to benefits provided to prospective and former employees in connection with their employment.

Some common types of fringe benefits include:

Fringe benefits can help employers attract, retain and motivate employees. Provision of ‘perks’ assists employers in obtaining an edge in competitive job markets. Often fringe benefits are offered through salary sacrifice as part of a packaging arrangement. This might push an employee into a lower tax bracket.

Employers (including state and federal government departments) are liable to pay Fringe Benefit Tax (FBT) on the fringe benefits they provide. Employers can often claim deductions for the cost of providing fringe benefits and the amount of FBT paid.

The FBT year is from 1 April to 31 March, and the ATO generally requires lodgement by 21 May.

The FBT rate for the years ending 31 March 2018 to 31 March 2023 is 47 per cent, calculated as follows:

Amount payable = taxable value of benefit x gross up factor x 47 per cent (FBT rate)

Taxable value of benefit: the rules for calculating the taxable value of a fringe benefit vary according to the type of benefit (the ATO publish a list of benefit types).

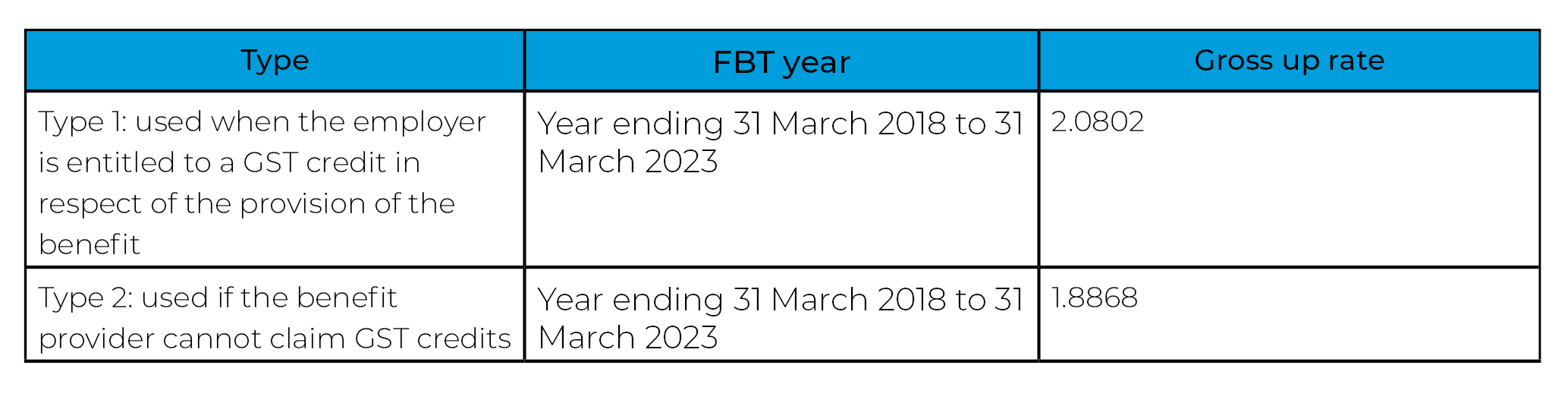

Gross up factor: there are two types of gross up factor:

The applicable gross up rate depends on whether the benefit provider is entitled to GST credits. An employer will be entitled to a GST credit if the benefit is provided in the course of the business and most benefits will be considered to be Type 1 benefits.

Curb Pty Ltd employs Larry. Curb provides a car benefit to Larry with a taxable value of $10,000.

The car benefit is taxed as follows:

Taxable value x Gross up rate | $10,000 2.0802 (because a car benefit is Type 1) |

| = grossed up taxable value | $20,802 |

x FBT Rate FBT Payable | 47 per cent $9,776.94 |

It is very important that employers keep accurate records on the amount of fringe benefits they have provided to their employees or risk being liable to penalties. Records must be kept for at least five years.

Employers are required to pay a certain amount of money to their employees to help them save for their retirement. As of September 2021 the total superannuation assets in Australia is worth $3.4 trillion.

The ATO takes any missed or underpaid super amounts by an employer very seriously.

An employer who has failed to pay the correct amount of superannuation for its employees will be liable for the superannuation guarantee charge (SGC).

The SGC is made up of the following payments:

The ATO has the powers to take stronger actions against employers who repeatedly do not pay the correct amount of superannuation or make it difficult for the ATO to determine an employer’s SGC liability. Some of the penalties involved in this situation can include:

In some cases, principals will need to make superannuation contributions to independent contractors.

Examples where superannuation contributions will need to be paid for independent contractors include if:

A failure to pay superannuation contributions to an independent contractor who is entitled to it can result in the same penalties as discussed above.

The ATO has a superannuation guarantee eligibility decision tool which can be used to help determine whether certain workers are entitled to superannuation. The tool can be accessed here.

Our tax team can assist you in obtaining certainty by providing advice to navigate complex employment tax issues, and where relevant, assisting with engagements with state revenue authorities and the ATO.

We can assist with: