16 September 2019

4 min read

Published by:

Medicare’s Shared Debt Recovery Scheme (the Scheme) took effect from 1 July 2019 and applies in circumstances where the Department of Health conducts post-payment Medicare compliance audits. The Scheme was brought to life by the Health Legislation Amendment (Improved Medicare Compliance and Other Measures) Act 2018 (Cth), which amended the Health Insurance Act 1973 (Cth).

Prior to the implementation of the Scheme, individual medical practitioners were liable for all Medicare claiming, except in cases of fraud. This model was suitable for traditional single-doctor practices, but was becoming problematic in the multi-doctor practices, large corporate entities and hospitals which exist today. There were concerns that, where billing practices are centralised, some employers may influence billing to maximise the Medicare benefits paid, even if that involves incorrect billing. Where billing practices are delegated away from medical practitioners, a fairer option is to attribute some responsibility to the organisation responsible for the Medicare claiming, rather than having medical practitioners pay for debts arising from Medicare claiming which they had no involvement in.

Medicare audits are typically undertaken to determine whether all elements have been met for a Medicare Benefits Scheme (MBS) item for which benefits have been paid.

The Scheme seeks to reduce incorrect billing practices, by facilitating joint contributions in response to Medicare audits to encourage the prompt repayment of incorrect Medicare billing.

The savings made as a result of the improved recovery of debt will cause increased funds to be reinvested in new services under the MBS and new listings on the Pharmaceutical Benefits Scheme (PBS), ensuring greater access to medicine for the Australian community.

When does the Scheme apply?

The Scheme will apply when:

What is the process involved?

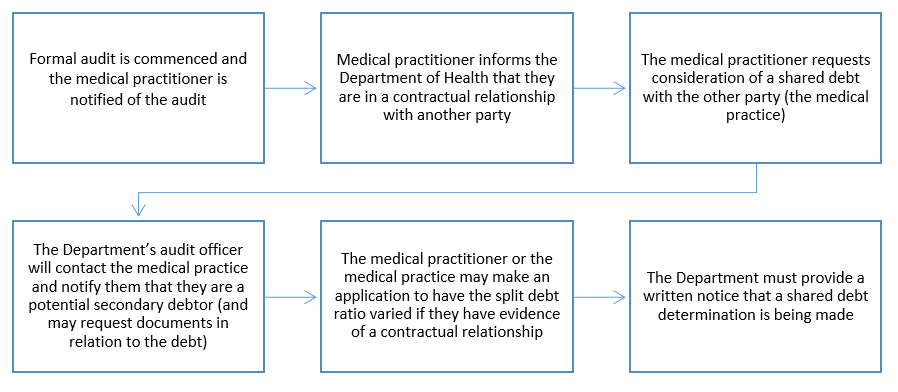

The Scheme is intended to operate in the below manner:

The Department’s written notice that they are making a shared debt determination, must include:

How is the debt apportioned?

The default apportionment percentage is 65 per cent to the primary debtor (the medical practitioner), and 35 per cent to the secondary debtor (the medical practice or employer).

The Department will consider whether a different percentage ought to be applied to the debt. Considerations include:

Is there an option to contract out of the Scheme?

There is no option to contract out of the Scheme. An agreement between a medical practitioner and medical practice or employer may play a role in the Department’s decision on how to apportion the debt, but this is not guaranteed. In all cases, the Department’s decision would be based on the evidence before the Department and not solely on the basis that the practitioner or medical practice offered to repay the debt.

Can a medical practitioner indemnify its employer or contracting entity from the compliance debt?

The Department is not bound to any terms or conditions in a contract between the primary and secondary debtor, including indemnity terms.

As indemnities are a creature of contract, it is possible to accept the determination given by the Department, and privately arrange for one party to indemnify the other against the entire debt. It is possible to draft a clear indemnity under which one party would indemnify the other against the entire debt. Such an indemnity would need to be very carefully drafted to ensure its operation.

Authors: Rachel Drew & Rose Dimitrious (née Sanderson)

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this newsletter is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: