28 July 2022

2 min read

Published by:

On 22 July 2022, the Australian Treasurer announced important changes to the Foreign Investment Review Board (FIRB) application fee regime.

The Commonwealth Government issued the Foreign Acquisitions and Takeovers Fees Imposition Amendment (Fee Doubling) Regulations 2022 (Cth) that will double the fees payable for FIRB approvals.

The increased fees will apply to foreign investment notifications and applications made on or after 29 July 2022.

If notice of a notifiable action is given or an application is lodged before 29 July 2022, the fee payable will be the fee specified in the pre-29 July 2022 fee schedule.

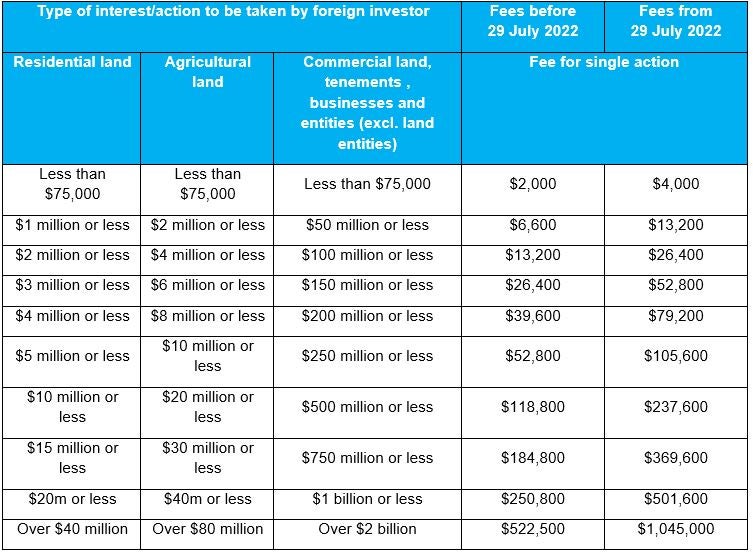

From 29 July 2022, the lowest applicable fee will increase from $2,000 to $4,000, and the highest applicable fee from $522,500 to $1.045 million.

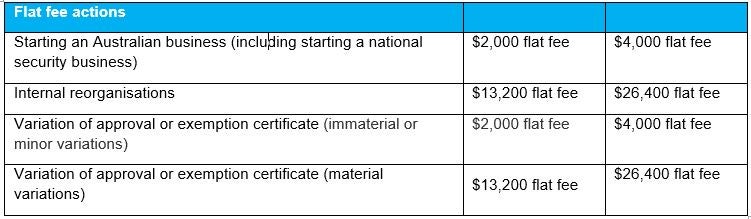

As a result of the new regulation, foreign investors may incur significantly higher costs to invest in Australia. We have summarised the key changes below:

The above fees will continue to be indexed annually.

The Government has also indicated that it will increase the penalties for non-compliance with Australia’s foreign investment laws. The anticipated increases are expected to double the current maximum penalties for certain breaches of Australia’s foreign investment laws.

As all foreign investment circumstances are unique, foreign investors should plan early for whether their proposed actions may require FIRB approval and budget for the increased cost of seeking FIRB approval.

We understand that the rules for calculating the fees payable to FIRB can be complex to navigate. However, it is essential that investors identify the correct fee payable at the time of lodgement of their FIRB applications. The timeframe for FIRB to consider applications only commences once the applicant has paid the relevant FIRB fee.

Carl Hinze (a fluent Mandarin speaker) and Jeanne Vallade (a native French speaker) assist clients with their investments regularly and advise on investment structures, regulatory approval processes and requirements, including detailed FIRB advice and FIRB approvals. Both are trusted advisors to many foreign clients investing and operating in Australia.

If you have any questions about the changes, contact Carl and Jeanne below or get in touch with the team here.

Authors: Carl Hinze & Jeanne Vallade

Disclaimer

The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.

Published by: